Loading

Get 18668970177

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 18668970177 online

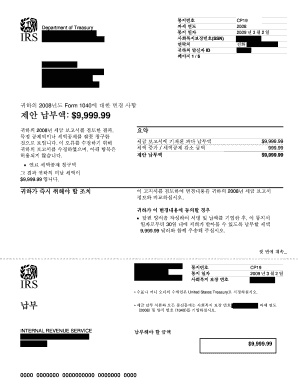

The form 18668970177 is an important document for addressing changes in your tax reports. This guide will provide you with clear instructions on how to efficiently complete this form online, ensuring that you follow the necessary procedures correctly.

Follow the steps to fill out the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the notification number section and ensure that you enter the correct notification number as it appears on your previous correspondence.

- Fill in the taxable year, making sure to indicate the correct year as noted in the document.

- Input the notification date accurately, as this detail is crucial for your records.

- Provide the Social Security Number (SSN) required in the specified field. Verify that this information matches your official documents.

- Enter your contact information, including a primary and secondary phone number for any necessary follow-up communications.

- Fill out the payment section, indicating the total proposed payment amount. Ensure that the figure aligns with the notification details.

- If you agree with the changes made to your tax report, mark the appropriate checkbox and provide the necessary signatures along with the date.

- If you disagree with the adjustments, complete the disagreement section and attach any relevant documents that support your claim.

- Once all required fields are filled out, review the entire form for accuracy. Save your changes, and you will have options to download, print, or share the completed form.

Complete your form online today to ensure timely processing and avoid any potential penalties.

Real IRS letters have either a notice number (CP) or letter number (LTR) on either the top or bottom right-hand corner of the letter. If there's no notice number or letter, it's likely that the letter is fraudulent. It's recommended you call the IRS at 800-829-1040.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.