Loading

Get Ny Ls 223 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY LS 223 online

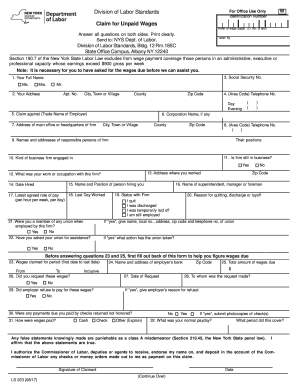

The NY LS 223 form is used to claim unpaid wages from an employer in New York. This guide aims to provide clear, step-by-step instructions to assist you in completing the form accurately and efficiently, ensuring that you can file your claim online with confidence.

Follow the steps to complete the NY LS 223 form online.

- Click ‘Get Form’ button to obtain the form and open it in your browser.

- Begin by filling in your full name in the designated field, ensuring to include any title such as Mr., Ms., or Mrs.

- Provide your complete address. Be sure to include your apartment number, city, county, and zip code.

- Enter your phone numbers, both daytime and evening, along with the area code.

- Specify the trade name of your employer in the 'Claim against' field.

- If applicable, provide the corporation name of your employer.

- List the address of the employer's main office or headquarters, including city, county, and zip code.

- Enter the phone number of the employer's main office, including the area code.

- Provide the names and addresses of responsible individuals at the firm, along with their positions.

- Indicate whether the firm is still in business by selecting 'Yes' or 'No.'

- State the kind of business the firm is engaged in.

- Detail the address where you worked.

- Describe your occupation or work performed with the firm.

- Fill in the name and position of the person who hired you.

- Enter the date you were hired.

- Provide the last day you worked for the employer.

- Indicate your latest agreed rate of pay, specifying whether it is per hour, per week, or per day.

- Enter the name of your supervisor or manager.

- Select your employment status with the firm: 'Quit,' 'Discharged,' 'Temporarily laid off,' or 'Still employed.'

- If applicable, indicate if you were a union member during your employment.

- If yes, provide the name, local number, address, zip code, and telephone number of the union.

- Indicate whether you requested assistance from your union and describe any action taken.

- Before addressing questions 23 and 25, fill out the back of the form to calculate wages due.

- Specify the period for which you are claiming wages by indicating the first and last dates.

- Enter the total amount of wages due in the space provided.

- Indicate whether you made a request for these wages and the date you made the request.

- Provide the name of the individual to whom the request was made.

- If the employer refused to pay the wages, provide the employer's reason for refusal.

- State whether you received any payments that were returned or not honored.

- Indicate how your wages were paid: 'Cash,' 'Check,' or 'Other.'

- If wages were paid by checks not honored, provide the check number(s).

- Note your normal payday and the period that this covered.

- Submit your signature affirming that the information provided is true.

- Finally, save your changes, then choose to download, print, or share the form as needed.

Complete your NY LS 223 form online today for a smoother claims process.

In New York, there is no specific limit to how many hours you can work straight without a break, but you do have rights under NY LS 223. If you work over a set number of hours, you are entitled to appropriate breaks throughout your shift. It's crucial to understand your rights to prevent burnout and maintain efficiency. For comprehensive understanding and tools, check out USLegalForms as a valuable resource.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.