Loading

Get Md New Hire Registry Reporting Form 2002-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD New Hire Registry Reporting Form online

Filling out the MD New Hire Registry Reporting Form online is an essential step in ensuring compliance with state reporting requirements for new hires. This guide provides clear and concise instructions to help users accurately complete and submit the form.

Follow the steps to complete the form effectively.

- Press the ‘Get Form’ button to access the reporting form and open it in the online editor.

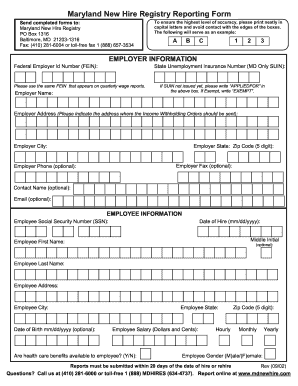

- Begin with the employer information section. Enter the Federal Employer Identification Number (FEIN) as it appears on quarterly wage reports. If the State Unemployment Insurance Number (SUIN) has not been issued yet, write 'APPLIEDFOR'; if the employer is exempt, indicate as 'EXEMPT'.

- Fill in the employer's name, address, city, state, and zip code. Ensure that the address listed is where income withholding orders should be sent. Provide optional contact details such as fax number, phone number, contact name, and email.

- Move to the employee information section. Enter the employee's Social Security Number (SSN) and date of hire in the format mm/dd/yyyy. Include the employee's first name, middle initial (if applicable), and last name.

- Complete the employee's address details, including city, state, and zip code. Optionally, include the employee's date of birth in mm/dd/yyyy format and their salary, specifying whether it is hourly, monthly, or yearly.

- Indicate whether health care benefits are available to the employee by selecting 'Y' for yes or 'N' for no. Provide the employee's gender using 'M' for male or 'F' for female.

- Review all entries for accuracy, print neatly in capital letters, and make sure not to contact the edges of the boxes.

- Once completed, save your changes, then choose to download, print, or share the form as needed.

Complete your MD New Hire Registry Reporting Form online today to ensure timely submission!

While you do not need to report new hires directly to the IRS, you must collect and submit tax information through the W-4 form. This form gives the IRS essential details necessary for tax withholding. Additionally, utilizing the MD New Hire Registry Reporting Form focuses on state reporting obligations, keeping you compliant at both levels.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.