Loading

Get Iht100b

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iht100b online

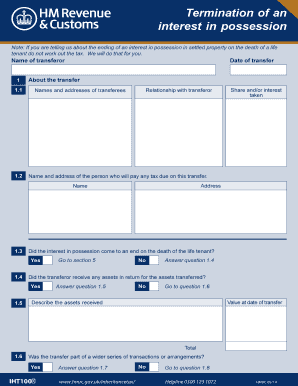

The Iht100b form is essential for reporting the termination of an interest in possession in settled property. This guide provides a clear, step-by-step approach to help users navigate filling out this form effectively.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to access the Iht100b form and open it in your preferred digital editor.

- Begin by entering the name of the transferor in the designated field. This is the individual who is transferring their interest in the property.

- Fill in the transfer date in the specified format, ensuring to provide the correct day and month to avoid filing errors.

- In section 1, provide the names and addresses of the transferees. Include their relationship with the transferor for context.

- Answer whether the interest in possession ended on the death of the life tenant. Select 'Yes' or 'No' and proceed to section 5 if applicable.

- If the transferor received any assets in return for the transferred assets, select 'Yes' or 'No' and provide details in the subsequent questions.

- Record the value at the date of transfer and describe the assets received, ensuring total values are accurately calculated.

- Indicate if the transfer was part of a wider series of transactions by answering the respective question. Proceed with additional questions based on your answer.

- Provide information on any previous transfers made by the transferor. This involves answering questions regarding chargeable gifts or transfers within a specific timeframe.

- Continuing to section 3, determine if the transferee took full possession of the assets transferred, and answer subsequent questions accordingly.

- If relevant, claim taper relief or relief on successive charges by providing necessary details in sections 4 and 5 as prompted.

- Complete the tax details in the respective sections concerning any foreign tax or previously paid tax, ensuring all numbers are added correctly.

- After reviewing all entries, save your changes, and choose to download, print, or share the completed Iht100b form.

Start filling out the Iht100b online today to ensure compliance and accurate reporting.

If your permanent home ('domicile') is abroad, Inheritance Tax is only paid on your UK assets, for example property or bank accounts you have in the UK. It's not paid on 'excluded assets' like: foreign currency accounts with a bank or the Post Office. overseas pensions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.