Get Tn Freddie Mac/fannie Mae Form 3043 2001-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

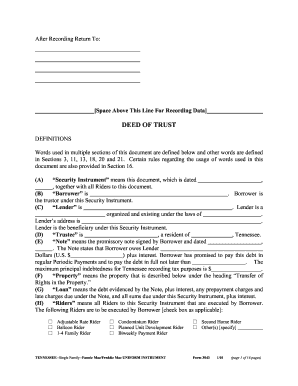

How to fill out the TN Freddie Mac/Fannie Mae Form 3043 online

This guide provides a detailed, step-by-step process for completing the TN Freddie Mac/Fannie Mae Form 3043 online, ensuring clarity and ease of use for all users, regardless of their legal experience. Follow these instructions carefully to ensure your form is accurately filled and submitted.

Follow the steps to complete your Form 3043 online.

- Click the ‘Get Form’ button to obtain the form and open it in your document editor.

- In the first section, enter the date where indicated. This is important for establishing the timeline of the agreement.

- Fill in the name of the Borrower and Lender. Ensure the correct legal names are used, as this information is crucial for the binding nature of the agreement.

- Provide the address of the Lender, as well as the address of the Property. Accurate details help in clear identification.

- Complete the section on the Note, specifying the amount borrowed and the interest rate. Include all necessary details regarding repayment.

- Select any applicable Riders by checking the appropriate boxes. This ensures that all supplementary agreements are acknowledged.

- In the transfer of rights section, clearly describe the property being secured. This might include specific identifiers such as lot numbers or parcel identifiers.

- Review all entered information for accuracy. Ensuring that every field is completed correctly helps avoid legal issues in the future.

- Once all fields are filled, save your changes, and prepare the document for submission. Depending on your preferences, download, print, or share the form as needed.

Complete your documents online with confidence and accuracy today.

The TN Freddie Mac/Fannie Mae Form 3043 plays a vital role in the mortgage application process, especially for lenders looking to meet federal guidelines. This form ensures that all necessary information is documented accurately, streamlining the approval process for both lenders and borrowers. By using this form, participants can facilitate smoother transactions and mitigate risks associated with mortgage lending. Proper navigation of this form can significantly enhance your experience in obtaining financing.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.