Loading

Get Base Tax Year And Current Tax Year

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Base Tax Year And Current Tax Year online

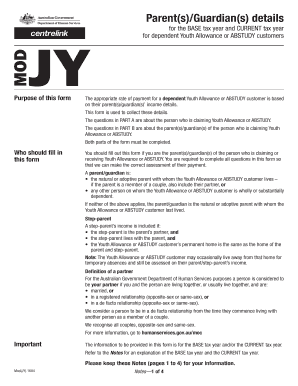

Filling out the Base Tax Year And Current Tax Year form is an essential step for parents or guardians of individuals claiming Youth Allowance or ABSTUDY. This comprehensive guide will provide clear instructions on completing the form online, ensuring that all necessary information is accurately submitted.

Follow the steps to successfully fill out the form online.

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin with Part A, which collects details about the Youth Allowance or ABSTUDY customer. Enter their full name as requested, ensuring accuracy.

- Provide additional details such as any other names the Youth Allowance or ABSTUDY customer has used, their date of birth, and their Centrelink Reference Number if known.

- Proceed to Part B, focusing on the parent(s)/guardian(s) details. Indicate your current relationship status by selecting the appropriate option.

- If applicable, answer questions about being a step-parent, ensuring to clarify whether the Youth Allowance or ABSTUDY customer normally resides with you.

- Complete income-related questions, ensuring to include taxable income for both the Base tax year and Current tax year. Attach any required documentary evidence where prompted.

- Indicate any relevant details regarding dependent children in your care if applicable, following the instructions carefully.

- Review all the information provided for completeness and accuracy. Ensure every required question is answered.

- Sign and date the form, then prepare the form for submission, either online or by mail.

- If submitting online, follow the guidelines to upload the form and any required documentation via your account. Alternatively, you may choose to return the form by post.

- Once completed, save any changes, download, print, or share the form as necessary.

Begin filling out the necessary documents online today to ensure timely processing of your Youth Allowance or ABSTUDY claims.

In the U.S., the tax year for individuals runs from Jan. 1 to Dec. 31 and includes taxes owed on earnings during that period. For example, taxes withheld or owed for earnings during the calendar year 2022 would be included on the tax return sent to the Internal Revenue Service (IRS) by most taxpayers in 2023.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.