Loading

Get (rp-5217) And The Transfer Tax Return (tp-584) - Syracuselandbank

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the (RP-5217) and the Transfer Tax Return (TP-584) - Syracuselandbank online

Navigating property purchase applications can seem daunting, but with a clear guide, you can efficiently fill out the necessary forms online. This guide provides step-by-step instructions to assist you in completing the (RP-5217) and the Transfer Tax Return (TP-584) for Syracuselandbank.

Follow the steps to accurately complete your property purchase forms.

- Click the ‘Get Form’ button to obtain the (RP-5217) and the Transfer Tax Return (TP-584) forms and open them in your editor.

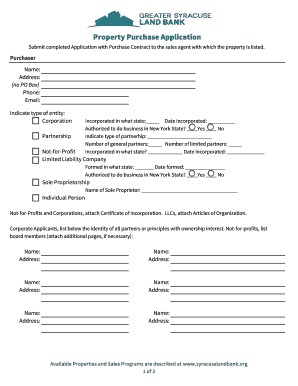

- Begin by filling out the purchaser information section. Provide your full name, complete address (not a P.O. Box), contact phone number, and email address. Indicate the type of entity, such as Corporation or Partnership, and fill in any relevant details about incorporation.

- In the sections for property ownership, answer any questions regarding prior ownership of properties in Onondaga County and relationships with the Greater Syracuse Property Development Corporation. Attach any necessary explanations if you answered 'yes' to these questions.

- For the property details, list the addresses of the properties you are interested in purchasing. Indicate your planned development or management approach by checking the appropriate boxes for actions like redevelopment or renovation.

- Complete the attachments section. Ensure you include all requested documents such as your experience qualifications, proof of financing, and any management plans if applicable.

- Review the signature section to certify that the information provided is accurate. Attach a copy of your photo ID as needed.

- Once all sections are filled out, save your changes. Choose to download, print, or share your completed forms as required.

Complete your property purchase documents online today for a smoother property acquisition process.

Summary Chart Conveyances of Commercial Real PropertyConveyanceTransfer Tax< 2M0.4%? $2M0.65%

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.