Loading

Get Form St18 Commonwealth Of Virginia Sales And Use Tax Certificate Of Exemption (for Use By A Farmer

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form ST18 COMMONWEALTH OF VIRGINIA SALES AND USE TAX CERTIFICATE OF EXEMPTION (For Use By A Farmer online

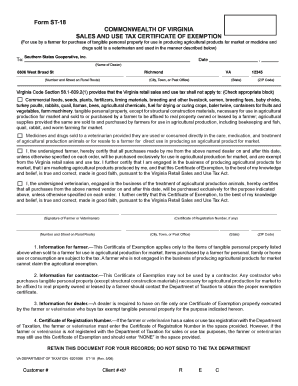

This guide provides a clear and concise overview of how to properly complete the Form ST18, the Commonwealth of Virginia sales and use tax certificate of exemption for farmers. This document is crucial for indicating tax-exempt purchases made by farmers in relation to agricultural production.

Follow the steps to fill out the certificate of exemption correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the dealer or vendor in the space provided labeled 'To:'.

- Fill in the date on which you are submitting the certificate in the designated space after 'Date'.

- Complete your address, including the number and street, city or town, state, and ZIP code.

- Review the exemption categories provided and check the appropriate boxes for the items that apply to your purchases as a farmer. This includes items such as seeds, livestock, and agricultural chemicals.

- In the certification section, affirm that you, the undersigned farmer, will purchase items exclusively for agricultural production purposes.

- Sign the form in the designated area, along with your Certificate of Registration Number if applicable. If you do not have a registration number, enter 'NONE'.

- Ensure all information is accurate, review the additional notes provided on the form that specify the scope of the exemption, and confirm that you meet the qualifications.

- Once everything is in order, save changes, download, print, or share the completed form as required.

Start completing your Form ST18 online today to ensure your agricultural purchases are tax-exempt!

Virginia State Code requires a minimum of five (5) contiguous (unimproved or more) acres. One acre is excluded for a house-site (if dwelling exists) or a proposed house-site. The remaining five acres or more may qualify for Land Use taxation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.