Loading

Get Pars Hardship Application - Pa Retirement Solutions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PARS Hardship Application - PA Retirement Solutions online

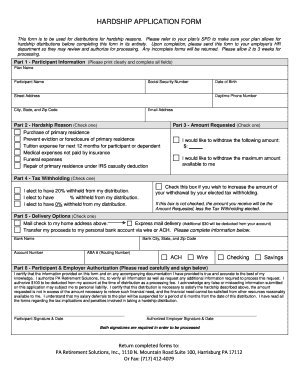

This guide provides a clear, step-by-step process for completing the PARS Hardship Application for PA Retirement Solutions online. The application is designed to assist participants seeking hardship distributions, ensuring that they follow the necessary procedures for approval.

Follow the steps to complete your application online.

- Press the ‘Get Form’ button to access the application form and open it in your preferred document editor.

- Begin with Part 1: Participant Information. Fill in all required fields including your plan name, participant name, social security number, date of birth, street address, daytime phone number, city, state, zip code, and email address.

- Move to Part 2: Hardship Reason. Check the box corresponding to your reason for requesting hardship distribution. Ensure this aligns with your plan’s provisions.

- Proceed to Part 3: Amount Requested. Indicate the specific dollar amount you wish to withdraw or select the option to withdraw the maximum amount available to you.

- In Part 4: Tax Withholding, choose your preferred tax withholding option. You can select 20%, a specific percentage, or no withholding. If you'd like to adjust your withdrawal amount for tax withholding, check the box provided.

- For Part 5: Delivery Options, select how you would like to receive your funds. Choose between mail delivery, express mail (note additional fees), or a transfer to your personal bank account. Complete the required bank information if applicable.

- Finalize your application in Part 6: Participant & Employer Authorization. Read the declaration carefully, then sign and date the form. Remember that both your signature and the authorized employer's signature are required.

- Once you have completed and reviewed the application, save your changes, and prepare to submit the form to your employer’s HR department. This can be done via mail or fax, as specified in the instructions.

Start your application now for an efficient and seamless experience in obtaining your hardship distribution.

Related links form

Unlike Social Security, when your employment ends with the District, you may withdraw your PARS ARS 457 Plan account in a lump-sum cash payment or roll it over to an IRA or another eligible retirement plan. Who is the administrator of the Los Rios Community College District's PARS ARS 457 Plan?

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.