Loading

Get Au Form F3520 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AU Form F3520 online

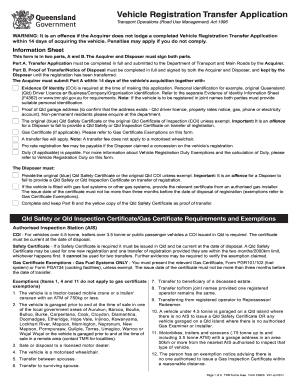

Filling out the AU Form F3520 online can be a straightforward process if you understand each section. This guide provides a clear, step-by-step approach to help you complete the Vehicle Registration Transfer Application accurately and efficiently.

Follow the steps to complete the AU Form F3520 online.

- Click ‘Get Form’ button to access the AU Form F3520 and open it in your online editor.

- Complete Part A of the transfer application. Ensure that you provide your full name and residential or business address in the registration details section. Confirm whether the vehicle's registration is current and if it has number plates attached.

- Enter the vehicle details, including the make, model, body shape, and the Vehicle Identification Number (VIN). Indicate whether you have a Customer Reference Number (CRN) and proceed as instructed.

- Fill out the disposer's details accurately. If registered in joint names, include all disposer's information and ensure both parts of the form are signed as required.

- In the vehicle registration dutiable value section, state the dutiable value of the vehicle as well as whether you are exempt from paying duty.

- Complete any additional sections based on the vehicle's specific requirements, such as gas certificates or safety inspections. Ensure all relevant documents are prepared for submission.

- Review all provided information for accuracy, ensuring both the acquirers and disposers sign where necessary on Part A.

- Finalize the process by choosing to save, download, or print the form, then submit it online along with the required documents to the Department of Transport and Main Roads.

Complete your vehicle registration transfer application online today for a hassle-free experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Completing an assessment typically involves gathering relevant data, evaluating it against predefined criteria, and drawing conclusions. Ensure that you provide a balanced overview of strengths and areas needing improvement. The AU Form F3520 can facilitate this process through structured guidance, ensuring thorough evaluations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.