Loading

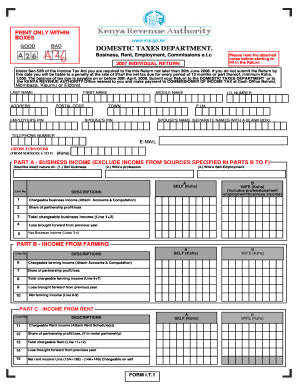

Get Ke Form I.t.1 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KE Form I.T.1 online

Filling out the KE Form I.T.1 online can seem daunting, but this guide will provide you with a comprehensive, step-by-step approach to streamline the process. By following these instructions, you can efficiently complete your tax return with confidence.

Follow the steps to successfully complete the KE Form I.T.1 online.

- Press the ‘Get Form’ button to access the required form and open it in your browser.

- Begin by inputting your personal information, including your first name, last name, middle name, and identification number. Ensure that your postal address is also complete, including your town and postal code.

- Provide your partner's information, if applicable, including their name and personal identification number. This section should be filled in the same manner as your details.

- Enter your contact details, including your telephone number and email address. This information is necessary for any correspondence concerning your submission.

- In the gross turnover field, indicate your total income from various sources as specified in the form.

- Complete Part A, entering your business income details. Clearly describe the nature of your self-business and your partner’s income sources. Ensure that all calculations are accurate.

- Continue to Parts B to F, where you will provide information about farming income, rental income, interest income, commission income, and any other specific sources of income. Attach necessary documents as indicated.

- In Part H, consolidate your total taxable income for both you and your partner. Be meticulous in adding all relevant income figures.

- Proceed to Part I to calculate the tax payable based on the total taxable income calculated in the previous step. Apply applicable rates as outlined in the instructions.

- Complete Part J, summarizing the final tax details, including any tax credits and penalties that may apply.

- In Part K, provide details of any payments made towards tax and any additional penalties incurred. Our system will summarize your total tax due or any refund that may be applicable.

- Fill in all necessary information in Parts L to P, ensuring you provide accurate details about employments, partnerships, landlord information, and any declarations required.

- Once all fields are completed, save your changes, download a copy for your records, print the form as needed, or share it if required.

Complete your KE Form I.T.1 online today for a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

No, Form 1040EZ has been discontinued as part of the IRS overhaul of tax forms. Now, all individuals must use the updated Form 1040 or its variations. If you’re looking for a straightforward filing method, consider the KE Form I.T.1 to assist you during tax season.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.