Get Canada T4 Summary 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T4 summary online

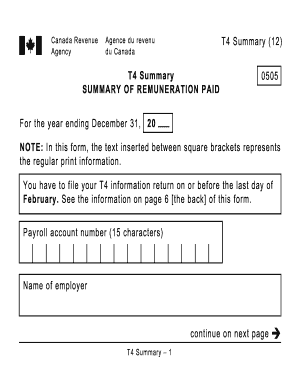

The Canada T4 summary is a crucial document for employers to report employment income and deductions for their employees. This guide provides clear instructions on how to effectively fill out this form online, ensuring compliance with the Canada Revenue Agency's requirements.

Follow the steps to complete the Canada T4 summary online.

- Click ‘Get Form’ button to obtain the T4 summary and open it in the editor.

- Enter your payroll account number, which is a 15-character identifier assigned by the Canada Revenue Agency.

- Fill in the name of the employer as it appears on official documents.

- Provide the employer's address, including the city, province or territory, and postal code.

- Indicate the total number of T4 slips you have filed for the reporting year.

- Complete the employment income section, ensuring to report the total amount paid to employees.

- Input the registered pension plan (RPP) contributions, pension adjustments, and the contributions made towards the Canada Pension Plan (CPP) for both employees and employers.

- Record the total Employment Insurance (EI) premiums for both employees and employers in the appropriate fields.

- Detail the total income tax deducted from the employees' earnings.

- Calculate the total deductions, ensuring it includes all the contributions and taxes reported earlier.

- If applicable, indicate any remittances and calculate the balance due or any overpayment from the previous year.

- Complete the certification section, providing your signature, position, and the date before submitting.

- After filling out all sections, save changes, download, print, or share the T4 summary as necessary.

Complete your T4 summary online today to ensure timely and accurate reporting.

Get form

Related links form

The T4 summary is a compilation of all the T4 slips your employer issues for a given tax year. It provides a comprehensive overview of total earnings and deductions for employees, making it easier to file taxes. Accurate entry of this information is vital for reflecting your annual financial situation. Using US Legal Forms can assist you in preparing and understanding your Canada T4 summary effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.