Get Sec Form D 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SEC Form D online

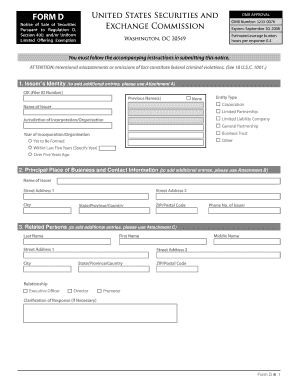

Filling out the SEC Form D online can seem daunting, but this guide will assist you through each step of the process. This form is necessary for issuers of securities that are seeking an exemption from registration under Regulation D of the Securities Act.

Follow the steps to complete and submit your SEC Form D successfully.

- Press the ‘Get Form’ button to access the SEC Form D in your online editor.

- Complete the 'Issuer’s Identity' section. Provide the legal name of the issuer, any previous names, type of entity, jurisdiction of incorporation, and year of incorporation. If additional issuers are involved, use Attachment A to provide their details.

- Fill in the 'Principal Place of Business and Contact Information' section. Enter the issuer’s full street address, including city, state, and ZIP code, along with a contact phone number. If there are multiple issuers, provide the main issuer's details first.

- In the 'Related Persons' section, list individuals with specific relationships to the issuer. Include their full names, addresses, and relationships such as executive officers, directors, and promoters. Use Attachment C for additional entries if necessary.

- Select the 'Industry Group' that best reflects the issuer's activities. If applicable, choose multiple groups that align with the issuer's business operations.

- Provide information about the 'Issuer Size' by entering the revenue range or net asset values. Indicate if you choose not to disclose this information.

- Select the relevant federal exemptions and exclusions claimed, according to provided guidelines. This will determine the compliance of your offering with federal regulations.

- Indicate the 'Type of Filing,' which includes options such as 'New Notice' or 'Amendment,' along with the 'Date of First Sale' if applicable.

- Answer the question about the 'Duration of Offering,' specifying if the offering is intended to last more than one year.

- Select the types of securities being offered, which can include equity, debt, options, and others as necessary.

- For 'Minimum Investment,' indicate the minimum dollar amount accepted from outside investors. If there is no minimum, enter ‘0’.

- Provide details on 'Sales Compensation,' including any commissions or fees owed to individuals involved in the selling process. Use Attachment D for additional entries as needed.

- Fill in the 'Offering and Sales Amounts' section, specifying the total offering amount, total amount sold, and any remaining amounts. Clarifications can also be added if necessary.

- Complete the 'Investors' section by specifying if securities have been sold to non-accredited investors and include the total number of investors who have participated.

- Describe the 'Use of Proceeds,' indicating how funds will be deployed or allocated from the offering.

- Finally, review all provided information for accuracy. Once verified, sign and submit the form. Ensure to retain a manually signed copy of the document for your records.

Now that you have the guidance to complete the SEC Form D online, proceed to fill it out and submit your documents efficiently.

Get form

Related links form

Regulation D of the SEC governs the exemptions that allow companies to sell securities without registering with the SEC. This regulation includes several rules, with Rules 504, 505, and 506 specifying the various conditions under which companies can operate. More importantly, Regulation D simplifies the fundraising process for startups, ensuring they have access to necessary capital while adhering to federal regulations. Knowing Regulation D can empower entrepreneurs to make informed decisions.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.