Get Sba 2404 2009-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SBA 2404 online

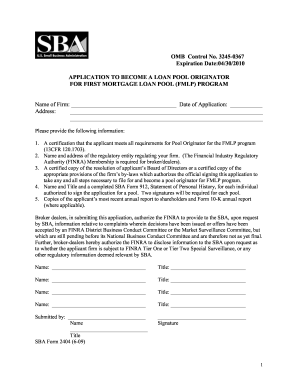

This guide provides comprehensive instructions on how to accurately fill out the SBA 2404 form online. Whether you are new to the process or need a refresher, this step-by-step approach will help ensure that you meet all necessary requirements for loan pool origination under the First Mortgage Loan Pool (FMLP) program.

Follow the steps to fill out the SBA 2404 form online effectively.

- Press the ‘Get Form’ button to obtain the SBA 2404 form and open it in your preferred editor.

- In the first section, enter the name of your firm and the date of application in the designated fields.

- Provide your firm’s complete address, ensuring all lines are filled in correctly.

- Select the certification box to affirm that you meet all Pool Originator requirements for the FMLP program as per 13CFR 120.1703.

- Input the name and address of the regulatory entity overseeing your firm. If you are a broker/dealer, include your Financial Industry Regulatory Authority (FINRA) membership details.

- Attach a certified copy of the Board of Directors' resolution or relevant by-law provisions that authorize the official signatory for this application.

- Add the names and titles of all individuals authorized to sign the application and complete an SBA Form 912 for each. Remember, two signatures are required for each pool.

- Include copies of the most recent annual report to shareholders and Form 10-K annual report if applicable.

- If submitting as a broker-dealer, ensure to include the authorization for FINRA to disclose relevant information to the SBA.

- Fill in the signature fields with the name and title of the submitting individual.

- Review all entries for accuracy and completeness, then save any changes, download, print, or share the completed form as needed.

Complete your SBA 2404 online today to begin your journey as a loan pool originator.

Related links form

Understanding the credit requirements for the SBA 504 program is essential for applicants. Typically, lenders look for a minimum credit score of around 650. However, factors such as business performance and financial history can also influence approval. Utilizing resources like uslegalforms can simplify the application process and provide guidance on meeting these criteria.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.