Loading

Get Shareholder Representation Letter

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Shareholder Representation Letter online

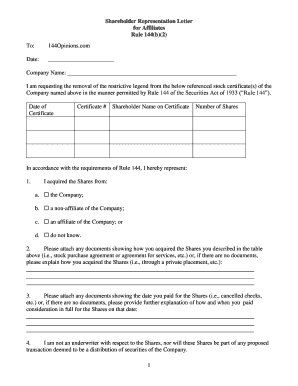

The Shareholder Representation Letter is an important document required for the removal of restrictive legends on stock certificates under Rule 144 of the Securities Act of 1933. This guide will assist you in completing the form accurately and efficiently, ensuring that all necessary information is provided online.

Follow the steps to fill out the Shareholder Representation Letter effectively.

- Click the ‘Get Form’ button to access the Shareholder Representation Letter online.

- Begin by entering the date in the designated field. Ensure that you use the current date when completing the form.

- In the Company Name field, provide the full legal name of the company related to the stock certificates.

- List the date and certificate number for each certificate in the appropriate table fields. This information ensures accurate identification of your shares.

- Enter your name as it appears on the stock certificate in the Shareholder Name field.

- Input the number of shares corresponding to each certificate listed in the previous field.

- For the section labeled 'In accordance with the requirements of Rule 144:', select the appropriate option to indicate how you acquired the shares. Be sure to check one box: from the company, non-affiliate, affiliate, or unknown.

- Attach relevant documents that detail how you acquired the shares. If there are no documents, briefly describe your acquisition method in the designated area.

- Attach documents showing the payment date for the shares. If none are available, explain how and when you made your payment.

- Indicate that you are not an underwriter regarding the shares and will not sell them as part of a distribution.

- Confirm whether you intend to sell the shares immediately on the public market.

- Acknowledge that after 90 days, the legal opinion might not be accepted by your transfer agent or brokerage.

- Confirm your status as an affiliate of the company as defined by Rule 144(a)(1).

- Indicate your awareness of any material non-public information regarding the company.

- Affirm that the company is not a shell company based on your knowledge and review of available information.

- Confirm that current public information about the company is accessible as required by Rule 144.

- Assert that this transaction does not evade registration requirements.

- Attach a copy of Form 144 filed with the United States Securities and Exchange Commission for this transaction.

- Confirm that you have not solicited any orders to buy in anticipation of this transaction.

- Indicate your intention not to sell additional securities of the same class through any other means.

- Confirm that you have not sold any shares in the last three months.

- Verify that the shares involved in this transaction do not exceed quantity limitations.

- Review the document for accuracy and completeness. Once finalized, proceed to save your changes, and download, print, or share the completed form as required.

Complete your Shareholder Representation Letter online to ensure compliance and ease of processing.

Rule 144A provides a mechanism for the sale of securities that are privately placed to QIBs that do not—and are not required—to have an SEC registration in place. Instead, securities issuers are only required to provide whatever information is deemed necessary for the purchaser before making an investment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.