Loading

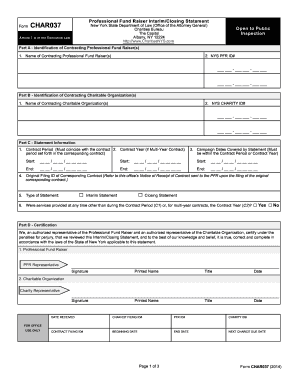

Get Form Professional Fund Raiser Interim/closing Statement Char037 New York State Department Of Law

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Professional Fund Raiser Interim/Closing Statement CHAR037 New York State Department Of Law online

Navigating the form CHAR037 can be straightforward when you follow a systematic approach. This guide provides detailed and user-friendly instructions to assist you in completing the Form Professional Fund Raiser Interim/Closing Statement online, ensuring accurate and compliant submissions.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Part A requires you to identify the contracting professional fund raiser(s). Fill in their name and NYS PFR ID# as prompted.

- In Part B, provide the name of the contracting charitable organization(s) and their NYS Charity ID#, ensuring accurate entry.

- Move to Part C, which contains statement information. Specify the contract period that aligns with the associated contract and indicate the exact campaign dates covered by your statement.

- Indicate the original filing ID of the corresponding contract as referenced in the notice sent to you by the PFR upon filing the original contract.

- Select whether the statement is an interim or a closing statement by checking the appropriate box.

- Answer the question regarding whether services were provided outside the contract period. Select 'Yes' or 'No' and proceed based on your experience.

- In Part D, both authorized representatives (from the Professional Fund Raiser and Charitable Organization) must certify the accuracy of the statement by providing signatures, printed names, titles, and dates.

- Part E requires you to specify the methods of solicitation and types of contributions solicited. Check all applicable boxes and provide further details if necessary.

- Complete Part F, the financial report section, ensuring all revenues and expenses are reported accurately according to the instructions provided.

- After completing all parts of the form, thoroughly review your entries for accuracy, then save your changes, and finalize by downloading, printing, or sharing the form as needed.

Complete your Form Professional Fund Raiser Interim/Closing Statement CHAR037 online today for a professional submission.

Most organizations that hold property of any kind for charitable purposes or engage in charitable activities in New York or solicit charitable contributions (including grants from foundations and government grants) in New York are required to register with the Office of the New York State Attorney General's Charities ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.