Loading

Get Hightechlending Loan Processor Document Certification Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HighTechLending Loan Processor Document Certification Form online

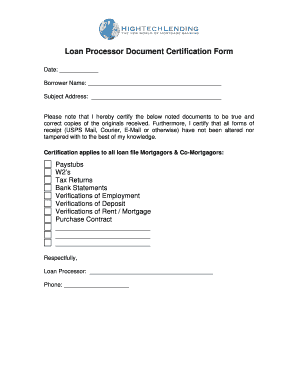

Filling out the HighTechLending Loan Processor Document Certification Form online can streamline your loan processing experience. This guide will walk you through each section of the form, ensuring that you understand how to accurately complete it.

Follow the steps to fill out the form accurately and efficiently.

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

- Enter the date at the top of the form in the designated space. This is important for record-keeping purposes.

- In the ‘Borrower Name’ field, input the full name of the borrower as it appears on official documentation.

- Fill in the ‘Subject Address’ field with the address associated with the loan. Ensure this information is accurate as it pertains to the mortgage application.

- In the certification statement, confirm that the documents listed below are true and correct copies of the originals. This includes paystubs, W2s, tax returns, and other specified documents.

- List all forms of receipt next to the certification statement. Indicate how you received the documents (e.g., USPS Mail, Courier, E-Mail), assuring that they have not been altered or tampered with.

- Make sure to certify that this applies to all loan file mortgagors and co-mortgagors, ensuring comprehensive coverage.

- Provide your typed or handwritten signature in the ‘Loan Processor’ section to authenticate your certification.

- Enter your phone number in the designated space so that you can be contacted if any additional information is required.

- Once all sections are completed, review the form for accuracy. You can then save your changes, download a copy for your records, print it, or share it as needed.

Complete the HighTechLending Loan Processor Document Certification Form online today for a smooth loan processing experience.

Related links form

Processor certifications allow job seekers to demonstrate their competency as an processor to employers. However, not all processor certifications provide the same value for job seekers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.