Loading

Get Health Savings Account Application Simplifier - Mecu

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HEALTH SAVINGS ACCOUNT APPLICATION Simplifier - Mecu online

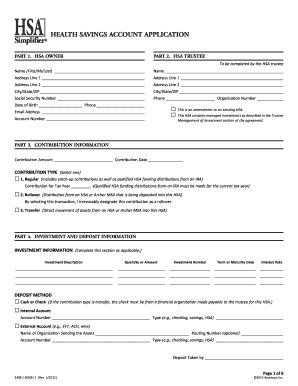

Filling out the Health Savings Account Application Simplifier - Mecu is an important step in setting up your health savings account. This guide will provide you with clear instructions on how to complete each section of the application efficiently and accurately.

Follow the steps to complete your application effectively.

- Press the ‘Get Form’ button to access the application form. This will allow you to download or open the form in your preferred editing tool.

- Enter your personal information in Part 1: HSA Owner. Include your full name, address, contact information, social security number, and date of birth.

- In Part 2: HSA Trustee, complete the trustee's information. Input the name, address, organization number, and contact details of the trustee managing your HSA.

- Proceed to Part 3: Contribution Information. Specify the contribution amount, date, and type. Select whether it is a regular contribution, rollover, or transfer.

- Move on to Part 4: Investment and Deposit Information. Fill in the investment description, quantity or amount, investment number, term or maturity date, and interest rate if applicable. Indicate your preferred deposit method.

- In Part 5: Beneficiary Designation, list your primary and contingent beneficiaries. Ensure the total percentage designated equals 100%. Include their names, addresses, dates of birth, relationships, and social security or tax ID numbers.

- Review and complete Part 6: Spousal Consent if necessary, and Part 7: Signatures. Make sure all required signatures are obtained, including yours and your spouse's if applicable.

- Once all sections are completed, save your changes. You can then download, print, or share the form as needed.

Complete your Health Savings Account Application online today to take advantage of tax benefits and savings for your medical expenses.

A Health Reimbursement Arrangement (HRA) isn't traditional health coverage through a job. Your employer contributes a certain amount to the HRA. You use the money to pay for qualifying medical expenses. For some types of HRA, you can also use the money to pay monthly premiums for a health plan you buy yourself.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.