Loading

Get Airbnb Expenses Spreadsheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Airbnb Expenses Spreadsheet online

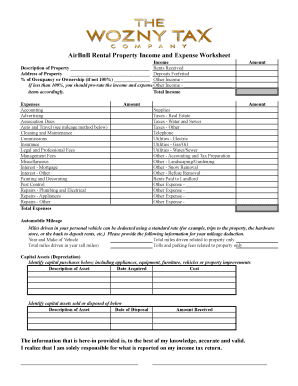

The Airbnb Expenses Spreadsheet is a valuable tool for individuals managing rental properties. This guide provides structured, step-by-step instructions to help users accurately fill out the spreadsheet online, ensuring a comprehensive overview of income and expenses related to their rental activities.

Follow the steps to complete the Airbnb Expenses Spreadsheet online.

- Press the ‘Get Form’ button to access the Airbnb Expenses Spreadsheet and open it in the editor.

- Begin by entering the description of the property and its address in the designated fields.

- Indicate the percentage of occupancy or ownership if it is less than 100%. This helps in prorating the income and expenses accurately.

- In the income section, list all types of income, including rents received, deposits forfeited, and any other relevant income. Be sure to sum them up for the total income.

- Move to the expenses section. Here, you should categorize your expenses under various headings such as accounting, advertising, cleaning, etc., and input the appropriate amounts.

- For automobile mileage, provide the vehicle details and record the total miles driven related to the property. Include tolls and parking fees as applicable.

- Identify capital assets by detailing descriptions, acquisition dates, and costs for any assets purchased. Also, list any assets that have been sold or disposed of, noting the date and the amount received.

- Review all entered information for accuracy, ensuring completeness across all sections.

- Once satisfied with your entries, save your changes, download the completed form, or choose to print or share it as needed.

Start filling out your Airbnb Expenses Spreadsheet online today for organized expense management!

What Is the Average Airbnb Host Salary by State StateAnnual SalaryMonthly PayNebraska$59,362$4,946Idaho$59,279$4,939California$58,143$4,845New Hampshire$57,648$4,80446 more rows

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.