Loading

Get Fl Donation Receipt 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL Donation Receipt online

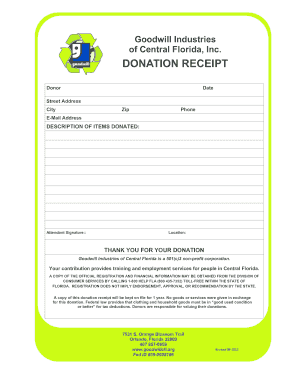

Filling out the FL Donation Receipt is a straightforward process that allows you to document your donations clearly and accurately. This guide will provide you with step-by-step instructions to help you complete the form online efficiently.

Follow the steps to complete the FL Donation Receipt.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the donor's name in the designated field. Provide your full name as it appears on your identification documents.

- Next, fill in the date of the donation. Ensure that the format is correct and corresponds to the intended donation date.

- Complete the donor’s address section, which includes your street address, city, and zip code. This information helps to verify your identity.

- Input your phone number and email address in the relevant fields. This contact information is important for any follow-up or queries regarding your donation.

- Describe the items donated in the required field. Be detailed and mention each item you are donating to provide a clear record.

- After you have filled out all the necessary sections, ensure you review all the information for accuracy.

- Once completed, you can save your changes. After saving, options will be available for you to download, print, or share the form as needed.

Complete your donation receipt online today to ensure your contributions are documented correctly.

While the IRS does not require a FL Donation Receipt for donations under $250, it is highly advisable to obtain one for your records. This receipt can serve as proof for your tax deductions if needed. It's better to be prepared and have documentation than to face complications later.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.