Loading

Get Automatic Payment Cancellation Letter

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Automatic Payment Cancellation Letter online

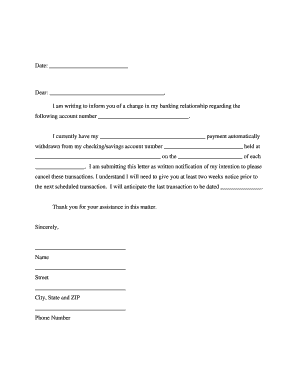

This guide provides step-by-step instructions on how to complete the Automatic Payment Cancellation Letter online. By following these directions, you can ensure that your payment cancellations are submitted accurately and efficiently.

Follow the steps to complete your cancellation letter online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, enter today's date in the provided space. This date indicates when you are sending the letter.

- In the 'Dear' section, write the name of the person or organization to whom the letter is addressed.

- Next, input your account number in the designated field to specify the account related to the payment modification.

- Indicate the type of payment you wish to cancel in the space provided. Include details such as the nature of the payment to clarify which transaction you refer to.

- In the next field, specify the checking or savings account number from which the payment is currently drawn.

- Name the financial institution that holds your account in the space provided.

- Indicate the frequency of the automatic payment (e.g., weekly, monthly) by filling in the blank.

- Fill in the date of the month when the payment is typically withdrawn from your account.

- Mention the anticipated last transaction date to inform the recipient of when the automatic payments should cease.

- Conclude the letter with a polite thank you note for their assistance.

- Sign the letter where indicated, including your full name, street address, city, state, ZIP code, and phone number.

- After reviewing all the information for accuracy, save your changes, download, print, or share the completed form as needed.

Start completing your Automatic Payment Cancellation Letter online today.

FAQs on closing bank accounts Closing a bank account doesn't affect your credit. If you forget to transfer all of your automatic payments to your new account or leave your old account with a negative balance you might be considered delinquent on your debts and see your credit score take a hit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.