Loading

Get Form St-6 Certificate Of Payment Of Sales Or Use Tax For ... - Mass.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form ST-6 Certificate Of Payment Of Sales Or Use Tax For ... - Mass.Gov online

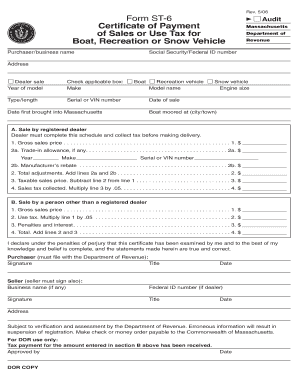

Filling out the Form ST-6 Certificate of Payment of Sales or Use Tax for boats, recreation vehicles, or snow vehicles is a critical step in ensuring compliance with Massachusetts tax regulations. This guide provides a clear and structured approach to completing the form, making it accessible for all users.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the Form ST-6 and open it in your chosen editor.

- Enter the purchaser or business name at the top of the form. Make sure to include the Social Security number or Federal ID number for proper identification.

- Fill in the address of the purchaser. This should be the current mailing address where correspondence can be sent.

- Indicate whether the sale was by a registered dealer or an individual. Select the appropriate check box for type of vehicle: boat, recreation vehicle, or snow vehicle.

- Provide details about the vehicle: make, model name, type/length, serial or VIN number, and whether it has been moored in Massachusetts.

- For sales made by a registered dealer, complete Section A. Record the gross sales price, any trade-in allowances, and manufacturer’s rebates. Calculate the taxable sales price and sales tax collected accordingly.

- If the sale was made by a person other than a registered dealer, complete Section B. Note the gross sales price, calculate use tax, and include any penalties and interest if applicable.

- After completing the required sections, both the purchaser and seller must sign and date the form. Ensure that all signatures are in place before submission.

- Finally, save your changes, download the completed form, and print or share it as necessary.

Complete your Forms online today to ensure accurate and timely submissions.

To report the exemption on your tax return: Enter the number of dependents you reported on U.S. Form 1040 into the box on your Form 1 (Line 2b) or your Form 1-NR/PY (Line 4b) Multiply that amount by $1,000 and enter the total amount on Form 1 (Line 2b) or Form 1-NR/PY (Line 4b)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.