Loading

Get Assignment Of Retail Installment Contract - Flagship Credit Acceptance

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Assignment Of Retail Installment Contract - Flagship Credit Acceptance online

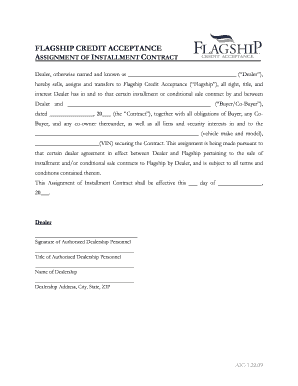

Filling out the Assignment Of Retail Installment Contract is an important process for dealers transferring contracts to Flagship Credit Acceptance. This guide will provide clear instructions on how to complete this form online, ensuring accuracy and efficiency.

Follow the steps to complete the form smoothly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Locate the section labeled ‘Dealer’ at the top of the form. Fill in the name of your dealership in the space provided.

- In the field for 'Buyer/Co-Buyer', enter the full name of the individual or individuals who are purchasing the vehicle.

- Next, specify the date of the original contract in the format ‘month, day, year’ under the section ‘dated’.

- For the ‘vehicle make and model’ field, enter the specific make and model of the vehicle being financed.

- Input the Vehicle Identification Number (VIN) in the corresponding field, ensuring it is accurate for identification purposes.

- Indicate the effective date of this assignment in the designated space, using the same format as step 4.

- A representative of the dealership should sign in the space for ‘Signature of Authorized Dealership Personnel’.

- Below the signature, enter the title of the authorized personnel who is signing the document.

- Complete the name of the dealership in the designated field and ensure the address, city, state, and ZIP code are correct.

- Once all sections are completed, review the form for accuracy. You can choose to save changes, download, print, or share the filled-out form.

Complete your documents online confidently and efficiently.

Installment loans (student loans, mortgages and car loans) show that you can pay back borrowed money consistently over time. Meanwhile, credit cards (revolving debt) show that you can take out varying amounts of money every month and manage your personal cash flow to pay it back.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.