Loading

Get Irs W-5 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-5 online

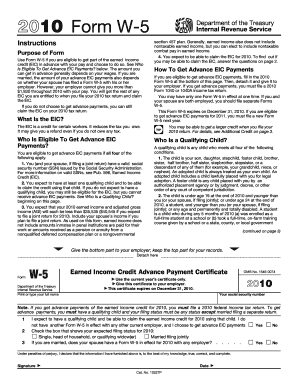

This guide provides clear instructions on how to complete the IRS W-5 form online. The IRS W-5 is a crucial document for those eligible for advance earned income credit payments, and understanding how to fill it out properly can ensure you receive the benefits you are entitled to.

Follow the steps to complete the IRS W-5 online.

- Press the ‘Get Form’ button to access the form and open it for editing.

- Enter your full name in the designated field on the form.

- Provide your social security number in the appropriate section.

- Indicate whether you expect to have a qualifying child and choose to receive advance EIC payments by checking the relevant box.

- Select your expected filing status for the year by checking the appropriate box.

- If applicable, specify whether your spouse has a W-5 form in effect with any employer.

- Sign and date the form, ensuring all information is correct to the best of your knowledge.

- Detach the completed form and submit it to your employer.

Complete your IRS W-5 form online today to ensure you receive your advance earned income credit payments.

To get IRS forms online, simply visit the IRS website and navigate to the forms section. You can search for the specific form, such as the IRS W-5, and download it directly to your device. This method provides quick access to all available forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.