Loading

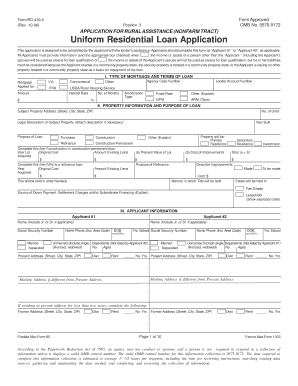

Get Form Approved Omb No 0575-0172 Application For Rural

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Approved OMB No 0575-0172 APPLICATION FOR RURAL online

Completing the Form Approved OMB No 0575-0172 APPLICATION FOR RURAL can seem daunting, but with guidance, it becomes a manageable task. This form is essential for individuals seeking rural assistance loans, and each section plays a crucial role in the application process.

Follow the steps to successfully complete the application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Section I, which asks for the type of mortgage and terms of the loan. Here, enter information regarding the intended loan type, including the mortgage amount, interest rate, and the subject property details.

- Proceed to Section II for property information. Fill in the subject property's address, the purpose of the loan (whether it's for purchase, construction, or refinance), and any existing liens.

- In Section III, provide detailed applicant information for both Applicant #1 and Applicant #2, including name, social security number, contact details, marital status, and housing history.

- Section IV requires employment information for both applicants. Fill in the employer's name, duration of employment, job title, and monthly income.

- Move on to Section V, where you will list gross monthly income and combined housing expenses. Be sure to include details for both applicants and any additional income sources.

- In Section VI, report assets and liabilities. Provide an overview of bank accounts, outstanding debt, and other relevant financial information.

- Section VII requires details of the transaction. Accurately fill in the purchase price and any associated costs.

- Complete Section VIII by answering declarations regarding your credit history and financial responsibility. Use continuation sheets if necessary for explanations.

- Finish with Section IX, where both applicants must acknowledge and agree to the terms outlined. Remember to sign and date the application.

- Finally, review all entries for accuracy, then save changes, download, print, or share the completed form as needed.

Start filling out your application for rural assistance online today!

The primary difference between USDA direct loans and USDA guaranteed loans is who funds the actual loan. With the USDA direct loan, the USDA acts as the lender. Conversely, with the guaranteed loan program, private lenders fund the loan while the USDA backs each loan against default.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.