Loading

Get Tofes 101 English

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tofes 101 English online

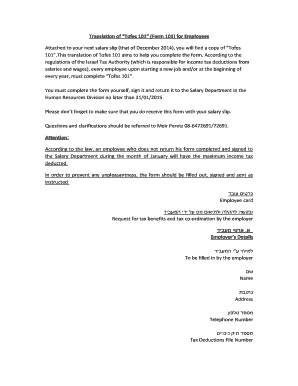

Filling out the Tofes 101 English form is essential for employees to provide accurate information for income tax deductions. This guide provides step-by-step instructions to help users complete the form confidently and correctly.

Follow the steps to complete the Tofes 101 English form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by entering the employer’s details in the designated section, which includes the name, address, telephone number, and tax deductions file number.

- Next, fill in your basic details as the employee, which includes your ID number, surname, first name, date of Aliyah, date of birth, home address (including street, neighborhood, town/village, and postcode), telephone number, gender, and family status.

- Provide details of any children under 19 years of age, including their ID number, date of birth, and whether they are in your custody or if you receive child support for them.

- Indicate your income details from this employer by specifying your monthly salary, salary for additional employment, any partial salary received, and other relevant compensation.

- If applicable, provide information regarding any other sources of income and specify if you request tax credits for this income.

- Include details about your spouse's income, if applicable, ensuring to provide their ID number, name, and date of birth.

- Mention any changes that occurred during the year that may affect your taxes, such as marital status or changes in your financial situation.

- Review all entered information for accuracy, sign the form at the designated area, and make sure to date it.

- Finally, submit the completed form by saving changes, downloading a copy, printing it, or sharing it as required.

Complete your Tofes 101 English form online today to ensure accurate processing of your tax information.

The employer's contribution rates (current as of January 2023) for Israeli-resident employees are 3.55%, up to monthly income of ILS 7,122, and 7.6% on the difference between ILS 7,122 and the maximum monthly income of ILS 47,465.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.