Get Uk Hmrc P60(single Sheet) 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC P60(Single sheet) online

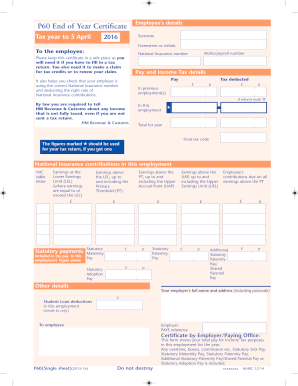

The UK HMRC P60(Single sheet) is an essential document that summarizes an employee's total pay and tax deductions for the tax year. This guide will walk you through the process of filling out the P60 form online, ensuring you have all the necessary information and understand each section.

Follow the steps to accurately complete your P60 form online.

- Click 'Get Form' button to access the form and open it in your preferred online editor.

- Begin by entering the employee's details. Fill in the surname and forenames or initials as they appear on your official documents.

- Next, input the works/payroll number, which is unique to your employment, followed by your National Insurance number.

- Move to the pay and income tax details. Here, you will enter the total pay received during the tax year and the total tax deducted. Ensure accuracy to reflect your records.

- If you have had previous employment within the same tax year, mark 'R' to indicate a refund.

- Review and complete the sections for National Insurance contributions based on your earnings during the employment period.

- Ensure to enter any statutory payments included in your pay if applicable, such as statutory maternity, paternity, or adoption pay.

- Fill in your employer's full name and address, including the postcode, at the appropriate section.

- Finally, check all your entered information for accuracy. Once confirmed, you can save the changes, download, print, or share the completed form.

Complete your P60 and other documents online today for a seamless process.

Get form

A P60 typically does not include dividends as it focuses on your employment income and taxes. If you receive income from dividends, you will report this separately on your tax return. The emphasis of the UK HMRC P60 (Single sheet) is on your earnings from employment, ensuring clarity on how much tax you owe or should receive as a refund. Always keep your documents organized to make tax filing easier.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.