Loading

Get Meals / Lodging Tax Return - City Of Manassas - Manassascity

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Meals / Lodging Tax Return - City Of Manassas - Manassascity online

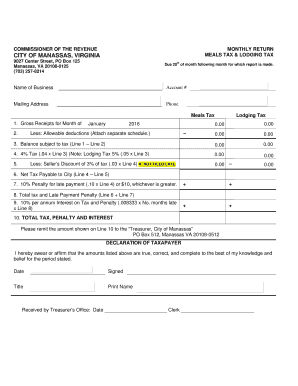

Filling out the Meals / Lodging Tax Return for the City of Manassas is an important task for businesses that provide meals and lodging services. This guide provides clear, step-by-step instructions to help users complete the form online accurately and efficiently.

Follow the steps to fill out your tax return seamlessly.

- Click ‘Get Form’ button to access the Meals / Lodging Tax Return and open it in a convenient digital format.

- Begin by entering the name of your business in the designated field. This ensures accurate identification of your tax account.

- Next, input your account number, which is crucial for maintaining your records and ensuring the tax is credited to the correct entity.

- Provide your current mailing address. This information is necessary for the city to reach you regarding your filing.

- Enter your business phone number in the appropriate field to facilitate any necessary communications.

- In the 'Gross Receipts for Month of' section, indicate the total revenue generated from meals and lodging during the specified month.

- If applicable, provide any allowable deductions in the specified area. Attach a separate schedule if necessary for clarity.

- Calculate the balance subject to tax by subtracting allowable deductions from gross receipts. Input this value in the designated field.

- Determine the applicable tax amounts: calculate meals tax (4%) and lodging tax (5%) based on the balance subject to tax and enter these values.

- If there are any late penalties, calculate them as outlined in the form and enter those into the appropriate section.

- Once all calculations and entries are complete, review the total amount due in the final section of the form.

- Finalize the form by signing and dating it to declare that the information provided is accurate to the best of your knowledge.

- Once finished, save any changes you made to the document, and if needed, download, print, or share it as required.

Complete your Meals / Lodging Tax Return online today to ensure timely and accurate submission.

The tax is 8% of the total amount paid by the guest or customer for use or possession of the room or space. The State also requires collection of sales tax on most room rentals.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.