Loading

Get Form No. 3ced See Sub-rule (1) Of Rule 10-i ... - Vat Faq

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM NO. 34F online

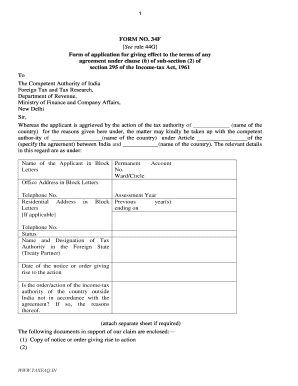

This guide provides clear instructions on how to complete FORM NO. 34F, which is used for applications concerning agreements under the Income-tax Act. Following this guide will help ensure that your submission is accurate and adheres to the required standards.

Follow the steps to successfully complete the form.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin filling out the form by entering your personal information in the designated fields, including your name, permanent address, and contact details in block letters.

- Provide your Ward/Circle and the assessment year, along with the previous year(s) ending on the specified date.

- In the section regarding the tax authority of the foreign state, enter the name and designation of the relevant tax authority.

- Detail the date of the notice or order that prompted the application and indicate whether the order is not in accordance with the specified agreement, along with the reasons for this claim.

- Attach any necessary supporting documents, such as a copy of the notice or order, ensuring that all required attachments are included.

- Complete the verification section by providing your details, declaration, and signature, confirming the accuracy of the information provided.

- Once all fields are completed, you can save your changes, download a copy of the form for your records, or print it for submission.

Start filling out your FORM NO. 34F online today for a smoother application process.

On Failure to furnish report under Form 3CEB Minimum penalty of INR 100,000 may be imposed. While if you fail to furnish information or documents pertaining to international transactions or specified domestic transactions under section 92D, a Penalty equivalent to 2% of the value of the transaction may be imposed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.