Loading

Get Form No.27 Authorisation Of An Accountant(s ... - Vat Faq

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM No.27 AUTHORISATION OF AN ACCOUNTANT(s) - VAT FAQ online

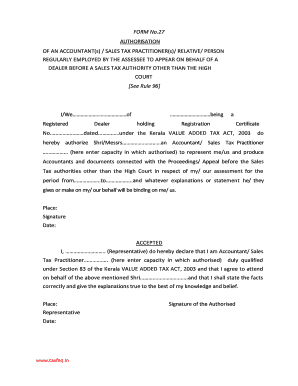

Completing the FORM No.27 AUTHORISATION OF AN ACCOUNTANT allows you to officially designate a qualified individual to represent you before sales tax authorities. This guide provides clear, step-by-step instructions to assist you in filling out this important document online.

Follow the steps to fill out the form accurately.

- Click the ‘Get Form’ button to access the form and open it in your editing tool.

- Begin by providing your name and registered dealer information in the designated fields. Ensure the details match exactly as they appear on your Registration Certificate.

- Enter your Registration Certificate number and the date it was issued. This information is crucial for validating your authorization.

- Designate the accountant or sales tax practitioner you are authorizing by filling in their name and title. Clearly state their capacity, such as 'Accountant' or 'Sales Tax Practitioner'.

- Specify the time period for which the authorization is valid by entering the opening and closing dates for the assessment period.

- Review the section where you confirm that the individual you are authorizing is capable of representing you. You need to include a statement that their actions on your behalf will be binding.

- Provide the location where you are signing the document, along with your signature and the date of signing.

- The representative should also fill out their information, including their name and capacity, followed by their signature and date to accept the authorization.

- Once all sections are completed, review the entire form for accuracy. You can then save changes, download, print, or share the form as needed.

Complete your documents online today for a streamlined process.

A Value-Added Tax (VAT) is a consumption tax assessed on the value added in each production stage of a good or service. Every business along the value chain receives a tax credit for the VAT already paid. The end consumer does not, making it a tax on final consumption.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.