Loading

Get Tcf Bank Ira Distribution Form 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TCF Bank IRA Distribution Form online

Filling out the TCF Bank IRA Distribution Form online can streamline the process of managing your retirement account. This guide provides clear instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

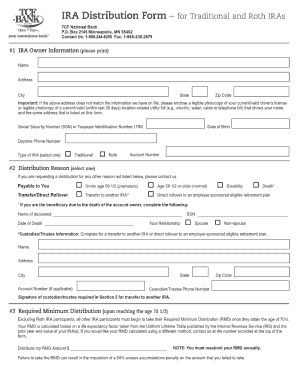

- Begin by entering your personal information in the designated fields. This includes your full name, address, and Social Security number. Ensure that all information is accurate and matches your official documents.

- Proceed to the account information section. Here, you will need to provide your TCF Bank account number associated with the IRA from which you are withdrawing funds.

- Next, indicate the type of distribution you are requesting. You may select options such as normal distributions, early withdrawals, or others as applicable. Carefully read the descriptions provided to choose the correct option.

- In the distribution amount field, specify how much you wish to withdraw from your IRA. Double-check that this amount aligns with your withdrawal intentions and with any tax implications.

- Complete the section on tax withholding preferences. This is crucial as it determines how much federal and state taxes will be deducted from your distribution.

- Review all the information you have entered for accuracy. Make sure that every field reflects the intended data to avoid any processing delays.

- Once you are satisfied with your entries, you can save changes to keep your progress. Additionally, options to download, print, or share the completed form will be available for your convenience.

Start completing your TCF Bank IRA Distribution Form online today to manage your retirement funds effectively.

To request a withdrawal from your IRA, you need to complete the IRA distribution form provided by your bank or financial institution. Simply fill in the required information regarding your account and the amount you wish to withdraw. Using the TCF Bank IRA Distribution Form, you can easily submit your request for a timely processing experience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.