Loading

Get Authority To Deduct Sample

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Authority To Deduct Sample online

This guide provides clear instructions on how to successfully fill out the Authority To Deduct Sample online. By following these steps, users can navigate the form with confidence and ensure accurate submission.

Follow the steps to complete your authorization form efficiently.

- Press the ‘Get Form’ button to access the Authority To Deduct Sample, opening the form in your preferred editing platform.

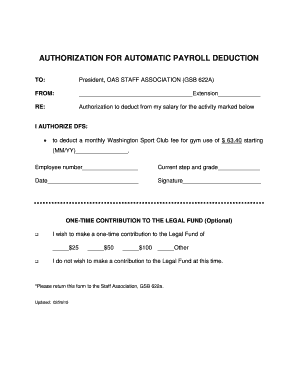

- In the 'TO' section, enter the full name and title of the recipient, which is the President of the OAS Staff Association, along with their address designation (GSB 622A).

- In the 'FROM' section, provide your name, along with your extension number, to identify yourself as the sender of the authorization.

- In the 'RE' field, indicate the purpose of the deduction clearly as 'Authorization to deduct from my salary for the activity marked below.'

- In the next section, authorize the deduction by filling in the relevant fee amount. For instance, if you wish to deduct a monthly fee for gym use, specify the amount ($63.40) and the starting date in MM/YY format.

- Input your employee number and current step/grade in the provided spaces, ensuring this information matches your official records.

- Date the form in the designated space to note when you are completing the authorization.

- Sign the form in the 'Signature' section to provide your consent for the deduction.

- For the one-time contribution to the Legal Fund, indicate your desired contribution amount by selecting one of the options or writing in a different amount if necessary.

- If you choose not to contribute, make sure to check the option stating you do not wish to make a contribution at this time.

- Finally, review all entries for accuracy before saving your changes, downloading, printing, or sharing the completed form as required.

Complete your documents online today to ensure timely processing.

Mandatory deductions: Federal and state income tax, FICA taxes, and wage garnishments. Post-tax deductions: Garnishments, Roth IRA retirement plans and charitable donations. Voluntary deductions: Life insurance, job-related expenses and retirement plans.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.