Loading

Get Ga8ng Salary Deferral Roth.doc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA8NG Salary Deferral Roth.doc online

This guide provides a comprehensive overview of how to complete the GA8NG Salary Deferral Roth.doc form online. By following these steps, you will be able to fill out the form accurately and efficiently.

Follow the steps to fill out the GA8NG Salary Deferral Roth form correctly.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

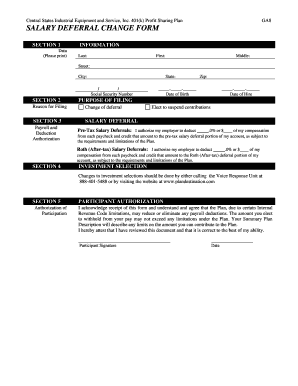

- Begin by filling out the personal information in Section 1. This includes your last name, first name, middle name, street address, city, state, zip code, and social security number. Ensure that all fields are completed in printed format.

- In Section 2, provide your date of birth and date of hire. You must enter these dates in the specified format.

- Move to the purpose of filing section and select the appropriate reason for filing. In this case, choose 'Change of deferral'.

- Proceed to Section 3, where you specify salary deferral options. Indicate whether you elect to suspend contributions, and if not, specify the percentage or dollar amount you want to defer for pre-tax and Roth (after-tax) salary deferrals. Ensure that you adhere to the requirements and limitations of the Plan.

- In Section 4, note that any changes to investment selections should be made by contacting the Voice Response Unit or visiting the designated website.

- For Section 5, provide your signature to authorize participation in the plan. Additionally, include the date when you complete the form. Make sure to review the details to confirm they are accurate.

- Once you have filled out all the sections, you can save your changes, download the completed form, print it out, or share it as needed.

Complete the GA8NG Salary Deferral Roth.doc form online today for efficient document management.

Generally speaking, pre-tax contributions are better for higher earners because of the upfront tax break, Lawrence said. But if your tax bracket is lower, paying levies now with Roth deposits may make sense.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.