Loading

Get Va Scc Llc-1014n 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA SCC LLC-1014N online

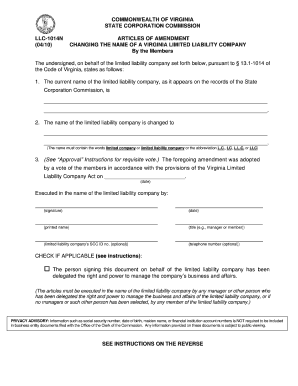

The VA SCC LLC-1014N form is essential for changing the name of a limited liability company in Virginia. This guide provides a clear and supportive overview to help users fill out the form accurately and efficiently, ensuring compliance with state regulations.

Follow the steps to successfully complete the VA SCC LLC-1014N form online.

- Press the ‘Get Form’ button to access the VA SCC LLC-1014N form in your browser.

- In the first field, enter the current name of the limited liability company as it appears in the State Corporation Commission records.

- In the second field, provide the new name for the limited liability company. Ensure that the new name includes the required terms, such as ‘limited company’ or ‘limited liability company’ or applicable abbreviations (L.C., LC, L.L.C., LLC).

- Refer to the guidelines regarding member approval. Indicate the date when the amendment was adopted by the members in the space provided.

- Sign the document in the section labeled ‘Executed in the name of the limited liability company by:’.

- Print your name beneath your signature.

- Indicate your title (for example, manager or member) in the designated area.

- Optionally, you may provide the limited liability company’s SCC ID number and telephone number.

- If applicable, check the box confirming the signer has delegated authority to manage the company.

- Once all fields are filled out, save the changes to your form, and download or print the completed document for submission.

Complete the VA SCC LLC-1014N form online today to streamline your business name amendment.

To file for an LLC in Virginia, you typically begin by selecting a unique name and preparing your articles of organization. Once ready, you file these documents with the Virginia State Corporation Commission. Additionally, using resources like the VA SCC LLC-1014N can help streamline the filing process. Remember, proper filing ensures your LLC operates legally and effectively in Virginia.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.