Loading

Get Nv App-01.00 2004

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NV APP-01.00 online

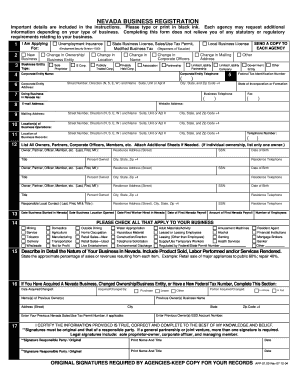

This guide provides clear and supportive instructions on completing the NV APP-01.00 form online. Whether you are a new business owner or updating your existing registration, following the steps below will ensure you provide the necessary information efficiently.

Follow the steps to successfully fill out the NV APP-01.00 online.

- Click the ‘Get Form’ button to access the NV APP-01.00 online. This will allow you to open the form in an editor where you can begin filling it out.

- Indicate what you are applying for by checking the relevant boxes at the top of the form. This section clarifies the type of registration you seek within Nevada.

- Select your business entity type by marking the appropriate box that describes your business structure. This will help identify the specific requirements for your application.

- Enter your corporate or entity name exactly as it appears in your registration with the Secretary of State. Remember to include a contact telephone number.

- Provide your Federal Tax Identification Number. If you do not have one yet, type ‘PENDING.’ Note that changes in this number require re-submission of the form.

- Fill in the corporate/entity address. Include the complete address, as it will be used for correspondence.

- In the field for ‘Doing Business in Nevada As,’ write the name under which your business will be known to the public, along with contact details.

- Include your business email address and website, if available, to enhance communication with regulatory agencies.

- State the mailing address for receiving your licenses and other documents. Ensure that this address is up-to-date.

- Document the locations of your business operations, making sure to list all addresses completely, including any relevant suite or apartment numbers.

- Provide the address where your business records are kept. This address is essential for verification purposes.

- List all owners, partners, corporate officers, and members. Include the necessary details for each person, such as full name, address, and ownership percentage.

- Record key dates concerning your business, such as the start date of operations and employee hiring dates.

- Indicate if applicable regulations affect your business by checking the relevant boxes. Attach any necessary documentation.

- Describe the nature of your business and its operations in Nevada. Be specific about your services or products and their contribution to revenue.

- If your business ownership has changed, complete this section with details about previous owners and any formerly held tax permits.

- Review and sign the form. Each signature must be original, and it is essential to keep copies of signed documents for your records.

- Once all required fields are completed, ensure you save the changes, download, print, or share your form as needed.

Start your business registration process online today by completing the NV APP-01.00 form!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Finding your entity ID number is straightforward. You can locate it on your business formation documents or through the Nevada Secretary of State's website. If you've recently filed your business registration, the entity ID should be included in the confirmation emails you received. For a more streamlined experience, consider using uslegalforms to access your business details.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.