Loading

Get Ga Dol-4a 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA DOL-4A online

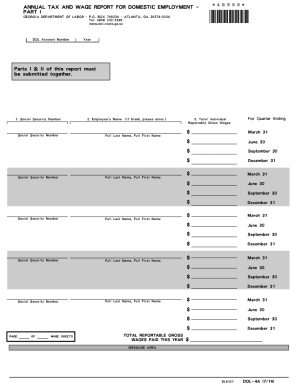

The GA DOL-4A is an essential form that employers must complete to report annual tax and wage information for domestic employment. This guide provides thorough, step-by-step instructions on how to accurately fill out the form online, ensuring compliance with the Georgia Department of Labor.

Follow the steps to successfully complete the GA DOL-4A.

- Click ‘Get Form’ button to access the GA DOL-4A and open it in the editor.

- Begin by entering your DOL account number in the designated field. If you are a new employer without an assigned DOL account number, simply enter 'Applied For'. Remember to attach the DOL-1A, Employer Status Report, if it has not been submitted previously.

- Fill in the report year, employer name, mailing address, and email address accurately to ensure effective communication.

- Input the Social Security Number, followed by the full last name and first name of each employee you are reporting for. Make sure to report total covered wages for each quarter individually.

- In Part II, report the total gross wages paid for all employees, clearly showing the amount paid for each quarter separately.

- Subtract any non-taxable wages from the total amount for each quarter. Non-taxable wages are defined as amounts exceeding $9,500 paid to each employee during the calendar year.

- Enter the difference obtained from the previous step, which will be used to calculate your tax obligations.

- Report the contribution tax rate in the provided area. This is calculated by multiplying your contribution tax rate (2.62% for new employers) by the taxable wages reported.

- Next, enter the administrative assessment rate. This rate (0.08% or 0.0008) should be multiplied by the amount figured in the tax due section.

- Calculate the total amount due by summing the amounts from the contribution tax and administrative assessment tax.

- Compile any taxes already paid for the reporting year and ensure they are documented in the corresponding section.

- Calculate the total annual tax due by summing the amounts owed for all quarters listed in the report.

- If your report is late, calculate any interest due at a rate of 1.5% per month since the due date of January 31.

- Include any penalties accrued from late submissions, which is either a flat $20 or 0.05% of total wages exceeding $40,000.

- In the final steps, enter the total of all penalties, taxes due, and interest to determine the total amount owed.

- Review all information for accuracy, complete any necessary changes in sections A-D, and then sign the report.

- Submit Parts I and II of the completed report by mail, or explore online payment options to fulfill your obligations.

Complete your GA DOL-4A online today to ensure compliance and avoid penalties.

To obtain a Georgia withholding tax number, you need to register with the Georgia Department of Revenue. This process usually involves completing an application that provides details about your business operations. After approval, you will receive your withholding tax number, which is essential for complying with state income tax withholding for employees.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.