Loading

Get Mo Forbearance Agreement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO Forbearance Agreement online

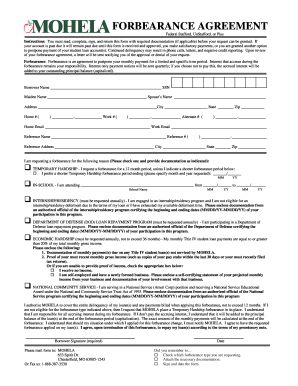

The MO Forbearance Agreement is a crucial document for individuals seeking to postpone their student loan payments temporarily. This guide provides clear, step-by-step instructions to help users complete the agreement accurately and efficiently online.

Follow the steps to fill out the MO Forbearance Agreement online

- Click the ‘Get Form’ button to access the MO Forbearance Agreement. This will allow you to open the form in your preferred online editor.

- Begin by entering your personal information. Fill in your name, Social Security number, and any maiden or spouse’s name, if applicable. Ensure that your address, city, state, and ZIP code are accurate.

- Next, provide your contact details, including home, work, and alternate phone numbers. Additionally, enter both your home and work email addresses for communication purposes.

- You will need to provide a reference name and phone number. Include the reference's address to ensure MOHELA can reach them if necessary.

- Indicate the reason for requesting forbearance by checking the appropriate box. Choose from options like 'temporary hardship,' 'in-school,' 'internship/residency,' 'Department of Defense loan repayment program,' 'economic hardship,' or 'national community service.'

- If you selected 'temporary hardship,' specify the duration if it is shorter than 12 months; otherwise, leave it as is. Ensure you attach the required documentation related to your reason for forbearance.

- Review and authorize MOHELA to cover delinquent payments and apply forbearance as indicated. Make sure you understand your responsibilities regarding accruing interest during forbearance.

- Sign the form at the designated area to confirm your agreement. Don't forget to include the date of signing.

- Before submission, verify that you have checked the type of forbearance requested, attached the necessary documentation, and signed and dated the form.

- Once completed, you can save changes, download, print, or share the MO Forbearance Agreement as needed. Ensure to mail it to MOHELA or fax it to the provided number.

Take action today and complete your MO Forbearance Agreement online.

To request forbearance from your mortgage company, start by gathering relevant documents, such as your income statements and any financial hardship details. Then, contact your servicer directly via phone or online portal to discuss your situation. Clearly explain your circumstances, and express your desire for a MO Forbearance Agreement. Make sure to follow their specific instructions to complete the process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.