Loading

Get Form Ih9 Sf# 48854 (r3 / 316) Prescribed By The Indiana Department Of Revenue Not For Public

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IH9 SF# 48854 (R3 / 316) Prescribed By The Indiana Department Of Revenue Not For Public online

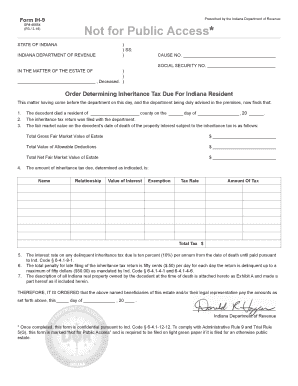

Filling out the Form IH9 SF# 48854 is an important step in the process of determining inheritance tax for the estate of a deceased individual in Indiana. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- In the first section, enter the cause number in the designated space provided. This number is essential for identifying the estate in question.

- Next, provide the name of the deceased person in the section labeled 'In the matter of the estate of'. Ensure that the name is accurate as per official records.

- Input the social security number of the deceased in the provided field. This information is necessary for tax identification purposes.

- Fill in the county where the deceased resided at the time of death, followed by the exact date of death in the specified format.

- Record the total gross fair market value of the estate in the respective field. This figure should reflect the estate's overall value as of the date of death.

- Next, enter the total value of allowable deductions which must be subtracted from the gross value. This will lead to the net fair market value of the estate.

- After these values, list the amounts relevant to each beneficiary, including their names, relationship to the deceased, value of interest, exemptions, tax rate, and the total tax due.

- Review the instructions concerning delinquent taxes and penalties for late filings to ensure compliance with Indiana law.

- Finally, confirm all entered information is accurate and complete. Once finished, you can save changes, download, print, or share the completed form.

Ensure that your documents are complete and accurate by following these steps online today.

Individual Partners – A partnership must withhold state income tax at the rate of 3.4 percent on the apportioned distributive shares of partnership income (on current-year earnings derived from Indiana sources) each time it pays or credits any of its nonresident and part-year resident individual partners.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.