Loading

Get Uk Hmrc Vat1614a 2009-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC VAT1614A online

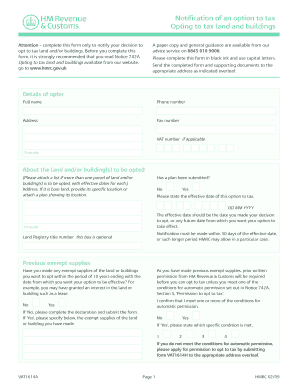

The UK HMRC VAT1614A form is a crucial document for notifying your decision to opt to tax land and buildings. It is essential to complete this form accurately to ensure compliance with tax regulations.

Follow the steps to fill out the UK HMRC VAT1614A form online effectively.

- Click the 'Get Form' button to obtain the form and open it for editing.

- Enter your full name in the designated field. Ensure that you use capital letters for clarity.

- Provide your phone number so HMRC can contact you if necessary.

- Fill in your address, making sure to include the postcode for accurate identification.

- If applicable, include your VAT number in the relevant section.

- About the land and/or building(s) you wish to opt for, enter the address in the designated field. If it is bare land, describe its specific location or attach a plan illustrating its location.

- Indicate whether a plan has been submitted by selecting 'Yes' or 'No'.

- State the effective date of the option to tax in the specified format (DD MM YYYY). This must reflect the date of your decision or a future date you wish it to take effect.

- If you have made any exempt supplies of the land or buildings, select 'Yes' or 'No'. If you choose 'No', you must complete the declaration and submit the form.

- If 'Yes', specify which conditions for automatic permission you meet by selecting them. If you do not meet these conditions, you must submit form VAT1614H.

- In the declaration section, confirm that the information provided is accurate. Sign the form, print your name, and date the notification.

- Indicate your status (e.g., director, partner) from the options provided.

- If someone other than the authorized persons is signing, attach a letter of authority to this form.

- If you are based outside the UK, indicate 'Yes' or 'No'. If 'Yes', confirm if you have appointed a UK representative.

- Retain records related to your option to tax for the duration that the option is effective.

- Send the completed form and any supporting documents to the appropriate address, ensuring you follow any specific guidelines provided.

Complete your UK HMRC VAT1614A form online today to ensure compliance with tax regulations.

Engaging in a deal with HMRC depends on your situation and the specifics of your tax obligations. If you are facing difficulties related to VAT1614A, HMRC may offer options for negotiations, including payment plans. It’s advisable to discuss your circumstances with a tax professional or use platforms like uslegalforms to navigate these discussions effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.