Get Usda Ccc-931 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the USDA CCC-931 online

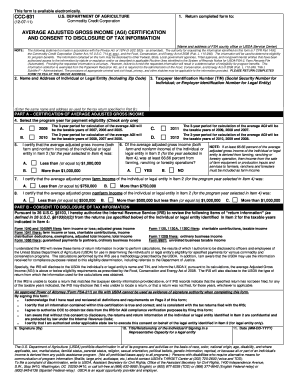

The USDA CCC-931 form plays a crucial role in certifying average adjusted gross income for eligibility in certain agricultural programs. This guide provides a clear, step-by-step process for filling out the form online, ensuring users can confidently navigate each section.

Follow the steps to complete the USDA CCC-931 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name and address of the person or legal entity in the appropriate fields. This should match the information that appears on the IRS tax return for the relevant years.

- Input the Taxpayer Identification Number (TIN) in the designated section. This could be a Social Security Number for individuals or an Employer Identification Number for legal entities.

- Select the program year for which you are seeking benefits by checking the appropriate box. This selection impacts the calculation of average adjusted gross income.

- Certify the average adjusted gross income for the selected year. Check the box that corresponds to your average adjusted gross income amount for the relevant three-year period.

- Indicate whether at least 66.66% of the average adjusted gross income comes from farming, ranching, or forestry operations by selecting ‘YES’ or ‘NO’.

- Choose the average adjusted gross farm income for the three-year period. Select only one applicable response.

- Select the average adjusted gross nonfarm income for the relevant period by marking one of the provided options.

- Review all acknowledgments regarding the information provided. Sign in the signature section to confirm that you have read and understood all responsibilities and authorize the USDA to access your tax information.

- Fill in your title or relationship to the individual or entity in the space marked for title/relationship.

- Enter the signature date in the MM-DD-YYYY format, ensuring that the form is returned to the designated FSA office within 90 days for the consent to be valid.

- Once you have completed the form, you can save changes, download a copy, print it, or share the form as needed.

Start completing your USDA CCC-931 form online today to ensure your eligibility for vital agricultural programs.

The time it takes to receive USDA certification varies depending on the specific program and your preparedness. Typically, the process can take anywhere from a few months to over a year. If you adhere closely to the USDA CCC-931 guidelines and provide all necessary documents, you may expedite the process. Patience and attention to detail are key during this journey.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.