Loading

Get Fin542s

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fin542s online

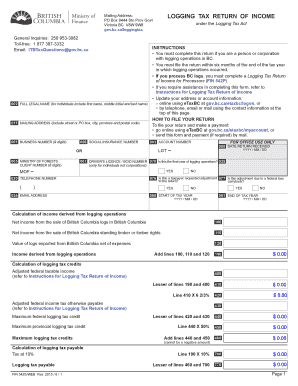

Filling out the Fin542s is a crucial step for individuals or corporations engaged in logging operations in British Columbia. This guide will provide you with clear, step-by-step instructions to complete the form online efficiently and accurately.

Follow the steps to complete the Fin542s online

- Press the ‘Get Form’ button to access the Fin542s and open it in your preferred online editor.

- Complete section 002 by entering the full legal name, which includes the first name, middle initial, and last name.

- Fill out section 011 with your mailing address, ensuring to include the street or PO box, city, province, and postal code.

- Input your business number in section 001, which should be nine digits.

- Provide your social insurance number in section 006.

- Enter your client number, which is eight digits long, in the designated field.

- In section 007, enter your driver's license or BCID number.

- Indicate whether this is the final year of logging operations in section 078 by selecting 'yes' or 'no'.

- Specify the start and end of the tax year in sections 060 and 061, respectively, using the format Yyyy / MM / Dd.

- Calculate the net income from logging operations based on the provided instructions, and enter the amounts accordingly in the calculation sections.

- Complete the payments section if applicable, indicating any amounts paid by instalments or showing any required paper documentation.

- Certify the form by signing in section 946 and providing your printed name, position, and the date signed.

- After reviewing all information for accuracy and completeness, save your changes, download, print, or share the completed form as needed.

Complete your Fin542s online to ensure compliance with logging tax regulations.

The logging tax is a 10 per cent tax that applies to individuals and corporations in BC that receive income related to log- ging operations from private and Crown land. The logging tax is only applicable to those individuals and corporations that own, or own the rights to the logs that are being sold.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.