Loading

Get Gfoa Sample Collateralization Agreement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GFOA SAMPLE COLLATERALIZATION AGREEMENT online

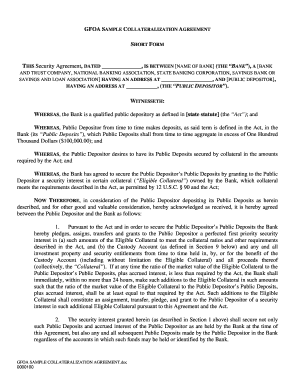

The GFOA sample collateralization agreement is a critical document that secures public deposits by outlining the relationship between a bank and a public depositor. This guide provides step-by-step instructions on how to complete this agreement efficiently and accurately online.

Follow the steps to fill out the GFOA sample collateralization agreement.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter the date in the designated field. Ensure it reflects the correct date of the agreement's execution.

- In the first section, input the name of the bank and its type (e.g., national banking association or state banking corporation) and the full address of the bank.

- Next, fill in the public depositor's name and address in the specified fields.

- Review the 'WITNESSETH' section, noting the agreement's foundation. Confirm the bank's qualifications as a public depository and the public deposits involved.

- In Section 1, detail the eligible collateral amounts the bank is pledging. Ensure compliance with requirements as described in the act.

- Proceed to complete Section 2, stating that the security interest covers all current and future public deposits, regardless of account identification.

- Fill out the pertinent sections regarding insurance coverage (Section 3) and the public depositor's right to withdraw deposits (Section 4).

- Sign and date the agreement in the required fields at the end of the document for both the bank and the public depositor.

- After filling out all sections and ensuring accuracy, save your changes, download a copy of the completed agreement, print it if necessary, or share it through your preferred online method.

Complete your GFOA sample collateralization agreement online today to ensure your public deposits are properly secured.

Georgia State Pledging Pool (Single Bank Pool) The bank is required to pledge collateral equal to or greater than 110% of the net public deposits (total minus FDIC coverage) of its public unit depositors that agree to have their deposits protected by the program.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.