Loading

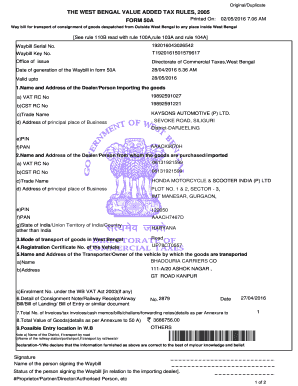

Get Original/duplicate The West Bengal Value Added Tax Rules, 2005 Form 50a Printed On: 02/05/2016 7

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Original/Duplicate THE WEST BENGAL VALUE ADDED TAX RULES, 2005 FORM 50A online

This guide provides users with a step-by-step approach to filling out the Original/Duplicate THE WEST BENGAL VALUE ADDED TAX RULES, 2005 FORM 50A. Whether you are familiar with digital forms or a first-time user, this comprehensive guide will assist you through each section of the form.

Follow the steps to complete your Form 50A efficiently.

- Click the ‘Get Form’ button to obtain the form and open it in the digital editor.

- Fill in the waybill serial number at the top of the form. Ensure that you have the correct serial number that corresponds to your shipment.

- Provide the waybill key number. This unique identifier is essential for tracking and verifying your form submission.

- Enter the office of issue, which should state 'Directorate of Commercial Taxes, West Bengal'.

- Input the date of generation of the waybill in the specified field.

- Indicate the valid date of the waybill. Make sure that the date falls within the valid range for processing.

- In Section 1, provide the name and address of the dealer or person importing the goods. Include the VAT registration number, CST registration number, trade name, address of the principal place of business, PIN code, and PAN number.

- In Section 2, fill out the details of the dealer or person from whom the goods are purchased or imported, including their VAT registration number, CST registration number, trade name, address, PIN code, PAN number, and the state or country.

- Fill in Section 3 by stating the mode of transport for the goods being brought into West Bengal. Ensure accuracy in this field to avoid issues during transit.

- Enter the registration certificate number of the vehicle used for transporting the goods in Section 4.

- Provide the name and address of the transporter or owner of the vehicle in Section 5, along with their enrolment number under the West Bengal VAT Act 2003, if applicable.

- In Section 6, complete the details for the consignment note or bill of lading or similar documents including the number and date.

- State the total number of invoices, tax invoices, cash memos, bills, or forwarding notes in Section 7.

- Complete Section 8 with the total value of goods, adhering to the details provided in the annexure.

- In Section 9, list the possible entry location in West Bengal, including the appropriate district if applicable.

- Review all entered information for accuracy before signing. The declaration must be completed by stating that the information is believed to be correct.

- Once all sections are completed and verified, save your changes, then download, print, or share the form as needed.

Utilize this guide to ensure your documents are completed correctly online.

payment of tax As per Section 22 (2) of VAT Act, if any dealer fails to pay the tax due within the time prescribed, interest at the rate of 1.25 per cent per month for the period of delay was liable to be paid in addition to such tax or penalty.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.