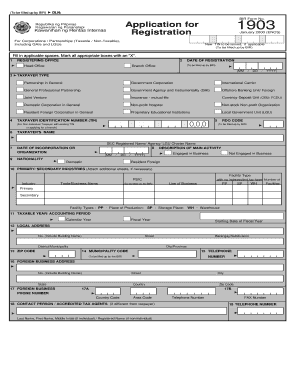

Get Ph Bir 1903 2000-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign PH BIR 1903 online

How to fill out and sign PH BIR 1903 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Selecting a legal expert, scheduling a meeting, and visiting the office for a face-to-face discussion makes completing a PH BIR 1903 from beginning to end tiring.

US Legal Forms enables you to swiftly create legally enforceable documents based on pre-designed online templates.

Effortlessly generate a PH BIR 1903 without needing to consult professionals. We already have over 3 million individuals benefiting from our extensive library of legal documents. Join us today and access the premier collection of online forms. Experience it for yourself!

- Obtain the PH BIR 1903 you require.

- Access it using the cloud-based editor and start modifying.

- Complete the empty fields; involved parties' names, addresses, and contact numbers, etc.

- Personalize the blanks with specific fillable areas.

- Insert the relevant date and add your electronic signature.

- Click Done after thoroughly checking all the information.

- Download the completed document to your device or print it out as a physical copy.

How to modify Get PH BIR 1903 2000: personalize forms on the internet

Authorize and distribute Get PH BIR 1903 2000 alongside any other commercial and personal documents online without squandering time and resources on printing and postal mail. Maximize our online form editor utilizing an integrated compliant electronic signature feature.

Authorizing and submitting Get PH BIR 1903 2000 templates digitally is faster and more efficient compared to handling them on paper. Nevertheless, it necessitates utilizing web-based solutions that guarantee a high level of data security and provide you with a compliant tool for creating eSignatures. Our reliable online editor is precisely what you require to finalize your Get PH BIR 1903 2000 and other personal and business or tax templates accurately and suitably, in line with all regulations. It comprises all the necessary tools to swiftly and effortlessly complete, alter, and sign documents online and insert Signature fields for other parties, indicating who and where should sign.

It takes merely a few straightforward steps to complete and sign Get PH BIR 1903 2000 online:

Distribute your document to others using one of the available methods. When signing Get PH BIR 1903 2000 with our powerful online tool, you can always be confident that it is legally binding and admissible in court. Prepare and submit documents in the most advantageous way possible!

- Access the chosen document for additional processing.

- Utilize the upper toolkit to incorporate Text, Initials, Image, Check, and Cross marks to your template.

- Highlight the essential information and block out or erase the sensitive ones if needed.

- Click on the Sign tool above and determine how you wish to eSign your form.

- Sketch your signature, type it, upload an image of it, or select another option that fits you.

- Navigate to the Edit Fillable Fields panel and place Signature fields for additional individuals.

- Click on Add Signer and provide the recipient’s email to allocate this field to them.

- Ensure that all information supplied is complete and accurate before you click Done.

Yes, a US citizen can obtain a TIN number in the Philippines by following the necessary procedures set by the BIR. They must complete the appropriate forms, including BIR Form 1903, and provide required documentation. Using services like US Legal Forms can assist in this process, ensuring compliance with PH BIR 1903 standards.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.