Loading

Get Transient Room Tax Collection Return - City Of Gearhart

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Transient Room Tax Collection Return - City Of Gearhart online

This guide provides a comprehensive overview of how to complete the Transient Room Tax Collection Return for the City of Gearhart online. By following these clear instructions, users can efficiently fill out the necessary fields and submit their returns with confidence.

Follow the steps to complete your tax collection return online.

- Click ‘Get Form’ button to obtain the form and open it for your use.

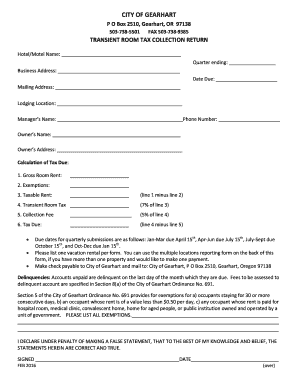

- Begin by entering the hotel or motel name in the designated field to identify the lodging property.

- Specify the quarter ending date for the return, ensuring that it aligns with the appropriate reporting period.

- Fill in the business address where the hotel or motel is located in the respective field.

- Note the due date for this form in the appropriate section to ensure timely submission.

- Enter the mailing address if it differs from the business address provided earlier.

- Input the lodging location, providing details of where the transient lodging occurs.

- Complete the manager’s name and phone number, detailing the individual responsible for the property.

- Provide the owner's name and their address in the specified fields.

- Calculate the gross room rent and record it in the corresponding field.

- Identify any exemptions applicable to your return and enter them in the exemptions field.

- Subtract the exemptions from the gross room rent to determine the taxable rent, and input this value.

- Calculate the transient room tax, which is 7% of the taxable rent, and write this amount in the field provided.

- Determine the collection fee, which is 5% of the transient room tax, and enter this value.

- Finally, calculate the tax due by subtracting the collection fee from the transient room tax and record this amount in the final field.

- Review all entered information for accuracy, then save changes, download, print, or share the form as required.

Complete your Transient Room Tax Collection Return online today to ensure compliance and avoid penalties.

Any person who has a written agreement with the operator, entered into within the first thirty (30) days of the person's occupancy, which states the person will stay for more than thirty (30) consecutive calendar days is exempt from the TOT, for the first 30 days of the person's stay.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.