Loading

Get Vat Form No 31a Bdeclarationb Of A Representative By Taxpayer - Inlandrevenue Finance Gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VAT Form No 31A Declaration of a Representative by Taxpayer - Inlandrevenue Finance Gov online

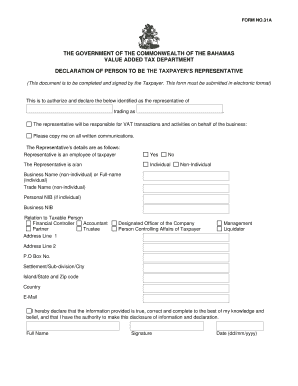

This guide provides a clear and supportive approach to filling out the VAT Form No 31A, which is required for designating a representative for VAT transactions. Follow the steps outlined below to complete the form correctly and efficiently.

Follow the steps to complete the VAT Form No 31A efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the section where you will authorize the representative. Enter the representative's full name and their business name, if applicable.

- Indicate whether the representative is an employee of the taxpayer by selecting 'Yes' or 'No.' This step is crucial for determining the representative's relationship to the business.

- Specify if the representative is an individual or a non-individual. If the representative is an individual, you will need to provide their Personal NIB. If it is a non-individual, enter the business NIB instead.

- Indicate the relationship of the representative to the taxable person by selecting from the given options, such as Financial Controller, Accountant, Partner, etc.

- Complete the address fields, including Address Line 1, Address Line 2, P.O. Box Number, Settlement/Sub-division/City, Island/State and Zip code, and Country.

- Provide the representative's email address for communication purposes.

- After entering all necessary information, review your entries carefully. By signing the form, you declare that all information provided is accurate to the best of your knowledge.

- Finally, submit the completed form electronically. You may also choose to save changes, download, print, or share the form as needed.

Complete your VAT Form No 31A online today to ensure your representative is authorized efficiently.

This form should be completed by agreement holders who are not registered for VAT and who are therefore not able to reclaim from HM Revenue and Customs the VAT element on goods and services which they have purchased.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.