Loading

Get Hr117-1 2005-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HR117-1 online

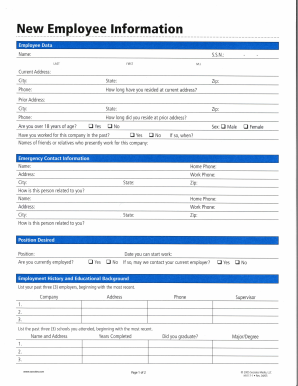

The HR117-1 form is an essential document used for collecting new employee information. This guide provides you with clear, step-by-step instructions on how to accurately fill out the form online, ensuring a smooth onboarding process.

Follow the steps to complete the HR117-1 online form successfully.

- Click the ‘Get Form’ button to obtain the HR117-1 form and access it in the designated editor.

- Enter your employee data: Fill in your name, social security number, current address, city, state, zip code, and phone number. Indicate how long you have resided at your current address.

- Provide prior address information including city, state, phone number, and the duration of residence at that address.

- Indicate whether you are over 18 years of age by selecting 'Yes' or 'No' and specify your sex.

- Answer whether you have previously worked for the company, and if so, provide the dates of employment and names of any friends or relatives currently employed there.

- Fill in your emergency contact information, including their name, home phone, work phone, address, city, state, zip, and the nature of your relationship.

- Specify the position you desire, your availability to start work, and whether you are currently employed. If employed, indicate if the current employer can be contacted.

- List your employment history by detailing your past three employers, starting with the most recent, including company name, address, phone number, supervisor, and education details.

- List the past three schools you attended, specifying their names and addresses along with the years completed.

- Include any special skills or abilities applicable to the position.

- Answer security-related questions regarding bond status and felony convictions to the best of your ability.

- If applicable, provide details about military service, including branch, rank, and any military commitments that could affect your work schedule.

- Complete the reasonable accommodations section if you believe you will require assistance performing your job.

- Certify the accuracy of your information by signing and dating the application.

- Save your changes, download, print, or share the completed HR117-1 form as necessary.

Complete the HR117-1 form online to streamline your onboarding process.

To complete a withholding exemption form, start by obtaining the correct document like the IRS Form W-4. Fill in your personal details, and clearly indicate the reasons for your exemption. Properly filling this out can help adjust your withholding accurately throughout the year, aligning with HR117-1 requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.