Loading

Get In Iatc State Form 43 2005-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN IATC State Form 43 online

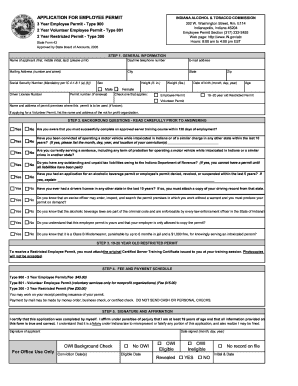

Filling out the IN IATC State Form 43 is an important step for individuals seeking an employee permit in Indiana. This guide will provide you with clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the form online effectively.

- Click ‘Get Form’ button to access the IN IATC State Form 43 in the online editor.

- Begin by entering your general information. Provide your full name (first, middle initial, last), daytime telephone number, city, social security number, email address, state, sex, height, weight, zip code, date of birth, and age. Ensure each field is filled out accurately as this information is crucial for your application.

- Indicate your driver’s license number and, if applicable, your permit number if this is a renewal. Then, select the type of permit you are applying for by checking the appropriate box. You can choose between Employee Permit, 19-20 year old Restricted Permit, or Volunteer Permit.

- If you know the premises where the permit will be used, provide the name and address of the permit premises. If applying for a Volunteer Permit, list the name and address of the nonprofit organization.

- Answer the background questions truthfully. These questions pertain to your knowledge of server training requirements, any previous convictions, and tax liabilities. Ensure that you provide accurate information as any discrepancies may affect your application.

- For those applying for a 19-20 year old Restricted Permit, you will need to attach the original Certified Server Training Certificate from your training session, as photocopies are not acceptable.

- Fill out the fee and payment schedule accordingly. Review the fees for your selected permit type and prepare your payment method, making sure not to send cash or personal checks. Payments can be made through money orders, business checks, or certified checks.

- Finally, sign the application to certify that all information is true and correct. Understand the implications of misrepresentation and remember to date your signature before submission.

- Once you have filled out the form completely and accurately, you can save your changes, download a copy for your records, and print or share the completed form as needed.

Complete your documents online today and ensure a smooth application process.

The form for the Iowa corporate income tax return is Form 1120. This form requires you to report your corporation's income, deductions, and credits. Depending on your corporate structure and financial details, you will want to ensure you align these details with the regulations set forth in the IN IATC State Form 43 for compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.