Loading

Get Windscreen Damage Claim Form - Tower Insurance

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

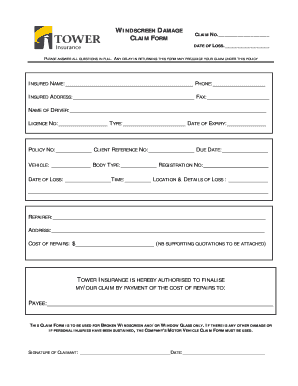

How to fill out the Windscreen Damage Claim Form - TOWER Insurance online

Filing a windscreen damage claim with TOWER Insurance involves completing a specific form accurately and thoroughly. This guide provides step-by-step instructions to help you navigate the Windscreen Damage Claim Form with ease, ensuring all necessary information is provided.

Follow the steps to successfully complete your claim form.

- Click ‘Get Form’ button to obtain the form and open it.

- Begin by filling in the claim number and date of loss at the top of the form. This information is crucial for tracking your claim.

- Provide your full name as the insured person, along with a contact phone number for any follow-ups. Include your physical address.

- List the name of the driver involved in the incident, their driver's license number, the type of license, and the expiration date.

- Enter your policy number and client reference number. Ensure these details are correct to avoid any complications.

- Fill out the vehicle details including model, body type, and registration number. Include the date and time of the loss, along with a detailed description of the location and event.

- Identify the repairer and provide their address. This information is essential for the claim process.

- Indicate the cost of repairs. Attach any supporting quotations to validate the repair costs.

- Authorize TOWER Insurance to finalize your claim by completing the payee information, ensuring the payments go to the correct party.

- Sign and date the form at the bottom to confirm the validity of your submission.

- Once all fields are completed, review the information for accuracy, then save changes. You may choose to download, print, or share the form as needed.

Start completing your Windscreen Damage Claim Form online today for a smooth claims process.

Is cover for personal possessions included in my car insurance? It depends on your level of cover. Comprehensive car insurance policies will typically include some level of personal possessions cover, but it doesn't usually come as standard on third party and third party, fire and theft policies.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.