Loading

Get Au Form B534e 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AU Form B534e online

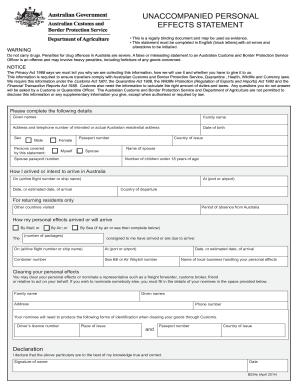

Filling out the AU Form B534e online is a critical step for individuals bringing personal effects into Australia. This guide provides detailed, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the AU Form B534e online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Carefully read the introductory notes on the form. Ensure you understand that this document is legally binding and that all fields must be completed in English using block letters.

- Begin filling out your personal information in the first section. Provide your given names, family name, address and telephone number of your intended or actual Australian residential address, and your date of birth.

- Indicate your sex by selecting either Male or Female. Include details for any persons covered by this statement, such as their passport number and name of spouse.

- Specify how you arrived or plan to arrive in Australia, including the airline flight number or ship name, and the port or airport. Provide your date or estimated date of arrival and country of departure.

- Describe how your personal effects arrived or will arrive, selecting from options such as Mail, Air, or Sea. Fill in the relevant fields such as container number and the name of the local business handling your personal effects if applicable.

- If you wish to nominate a representative for clearing your personal effects, fill in their details in the designated section, including their name, address, and phone number.

- Answer the questions in Sections One through Eight by placing a tick in the appropriate boxes. If you answer 'Yes' to any specific questions, provide additional details as required.

- Review your completed form thoroughly for accuracy. Ensure that you have initialed any errors or alterations as necessary.

- Sign and date the declaration at the end of the form to confirm that the information provided is true to the best of your knowledge.

- Once the form is completed, you can save any changes, download, print, or share it as required.

Begin filling out your AU Form B534e online today to ensure a smooth customs process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, when entering Australia, you are required to declare personal jewelry if it has significant value. Proper declaration is essential to avoid delays or issues with customs. Completing the AU Form B534e can simplify the declaration process for your jewelry.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.